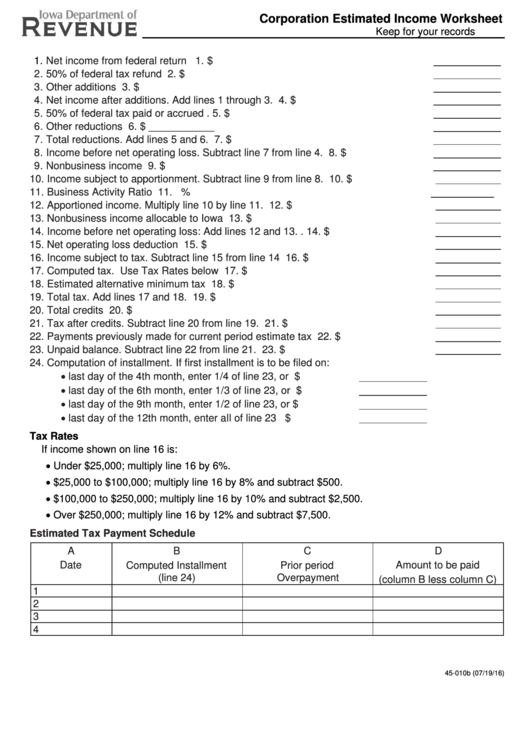

Corporation Estimated Income Worksheet

Keep for your records

https://tax.iowa.gov

1.

Net income from federal return ............................................................... 1. $

2. 50% of federal tax refund ............................................................................... 2. $

3. Other additions .............................................................................................. 3. $

4. Net income after additions. Add lines 1 through 3. .......................................... 4. $

5. 50% of federal tax paid or accrued ................................................................. 5. $

6. Other reductions ............................................................................................ 6. $ ___________

7. Total reductions. Add lines 5 and 6. ................................................................ 7. $

8. Income before net operating loss. Subtract line 7 from line 4. ......................... 8. $

9. Nonbusiness income ...................................................................................... 9. $

10. Income subject to apportionment. Subtract line 9 from line 8. ......................... 10. $

11. Business Activity Ratio .................................................................................. 11.

%

12. Apportioned income. Multiply line 10 by line 11. ............................................. 12. $

13. Nonbusiness income allocable to Iowa .......................................................... 13. $

14. Income before net operating loss: Add lines 12 and 13. ................................. 14. $

15. Net operating loss deduction ......................................................................... 15. $

16. Income subject to tax. Subtract line 15 from line 14 ....................................... 16. $

17. Computed tax. Use Tax Rates below ............................................................ 17. $

18. Estimated alternative minimum tax ................................................................ 18. $

19. Total tax. Add lines 17 and 18. ...................................................................... 19. $

20. Total credits .................................................................................................. 20. $

21. Tax after credits. Subtract line 20 from line 19. .............................................. 21. $

22. Payments previously made for current period estimate tax ............................. 22. $

23. Unpaid balance. Subtract line 22 from line 21. ............................................... 23. $

24. Computation of installment. If first installment is to be filed on:

last day of the 4th month, enter 1/4 of line 23, or .................. $

last day of the 6th month, enter 1/3 of line 23, or ............... $

last day of the 9th month, enter 1/2 of line 23, or................ $

last day of the 12th month, enter all of line 23 ................... $

Tax Rates

If income shown on line 16 is:

Under $25,000; multiply line 16 by 6%.

$25,000 to $100,000; multiply line 16 by 8% and subtract $500.

$100,000 to $250,000; multiply line 16 by 10% and subtract $2,500.

Over $250,000; multiply line 16 by 12% and subtract $7,500.

Estimated Tax Payment Schedule

A

D

B

C

Date

Amount to be paid

Computed Installment

Prior period

(line 24)

Overpayment

(column B less column C)

1

2

3

4

45-010b (07/19/16)

1

1