Form D-30cr - Qhtc Unincorporated Business Tax Credits

ADVERTISEMENT

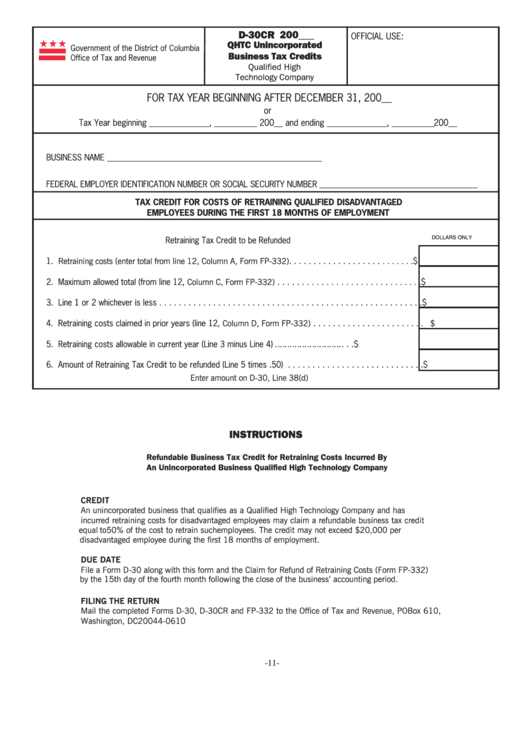

D-30CR

200___

OFFICIAL USE:

QHTC Unincorporated

Government of the District of Columbia

Business Tax Credits

Office of Tax and Revenue

Qualified High

Technology Company

FOR TAX YEAR BEGINNING AFTER DECEMBER 31, 200__

or

Tax Year beginning ______________, __________ 200__ and ending ______________, __________

200__

BUSINESS NAME _____________________________________________________

FEDERAL EMPLOYER IDENTIFICATION NUMBER OR SOCIAL SECURITY NUMBER _______________________________________

TAX CREDIT FOR COSTS OF RETRAINING QUALIFIED DISADVANTAGED

EMPLOYEES DURING THE FIRST 18 MONTHS OF EMPLOYMENT

DOLLARS ONLY

Retraining Tax Credit to be Refunded

1. Retraining costs (enter total from line 12, Column A, Form FP-332) . . . . . . . . . . . . . . . . . . . . . . . . . . $

2. Maximum allowed total (from line 12, Column C, Form FP-332) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

3. Line 1 or 2 whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

4. Retraining costs claimed in prior years (line 12, Column D, Form FP-332)

.

. . . . . . . . . . . . . . . . . . . . . . $

5. Retraining costs allowable in current year (Line 3 minus Line 4)

. . . . . . . . . . . . . . . . $

. . . . . . . . . . . . . .

6. Amount of Retraining Tax Credit to be refunded (Line 5 times .50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

Enter amount on D-30, Line 38(d)

INSTRUCTIONS

Refundable Business Tax Credit for Retraining Costs Incurred By

An Unincorporated Business Qualified High Technology Company

CREDIT

An unincorporated business that qualifies as a Qualified High Technology Company and has

incurred retraining costs for disadvantaged employees may claim a refundable business tax credit

equal to 50% of the cost to retrain such employees. The credit may not exceed $20,000 per

disadvantaged employee during the first 18 months of employment.

DUE DATE

File a Form D-30 along with this form and the Claim for Refund of Retraining Costs (Form FP-332)

by the 15th day of the fourth month following the close of the business’ accounting period.

FILING THE RETURN

Mail the completed Forms D-30, D-30CR and FP-332 to the Office of Tax and Revenue, PO Box 610,

Washington, DC 20044-0610

-11-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1