Nebraska Tax Calculation Schedule For Individual Income Tax - 2013

ADVERTISEMENT

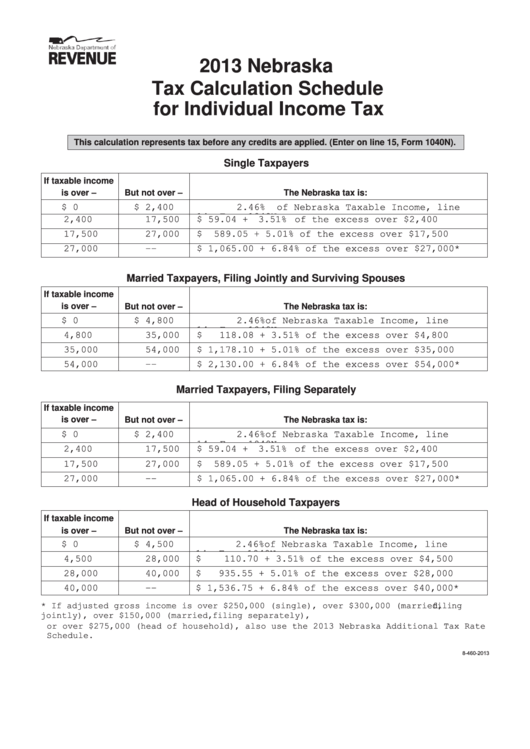

2013 Nebraska

Tax Calculation Schedule

for Individual Income Tax

This calculation represents tax before any credits are applied. (Enter on line 15, Form 1040N).

Single Taxpayers

If taxable income

is over –

But not over –

The Nebraska tax is:

$

0

$

2,400

2.46%

of Nebraska Taxable Income, line

14, Form 1040N

2,400

17,500

$

59.04 + 3.51% of the excess over $2,400

17,500

27,000

$

589.05 + 5.01% of the excess over $17,500

27,000

––

$ 1,065.00 + 6.84% of the excess over $27,000*

Married Taxpayers, Filing Jointly and Surviving Spouses

If taxable income

is over –

But not over –

The Nebraska tax is:

$

0

$

4,800

2.46% of Nebraska Taxable Income, line

14, Form 1040N

4,800

35,000

$

118.08 + 3.51% of the excess over $4,800

35,000

54,000

$ 1,178.10 + 5.01% of the excess over $35,000

54,000

––

$ 2,130.00 + 6.84% of the excess over $54,000*

Married Taxpayers, Filing Separately

If taxable income

is over –

But not over –

The Nebraska tax is:

$

0

$

2,400

2.46% of Nebraska Taxable Income, line

14, Form 1040N

2,400

17,500

$

59.04 + 3.51% of the excess over $2,400

17,500

27,000

$

589.05 + 5.01% of the excess over $17,500

27,000

––

$ 1,065.00 + 6.84% of the excess over $27,000*

Head of Household Taxpayers

If taxable income

is over –

But not over –

The Nebraska tax is:

$

0

$

4,500

2.46% of Nebraska Taxable Income, line

14, Form 1040N

4,500

28,000

$

110.70 + 3.51% of the excess over $4,500

28,000

40,000

$

935.55 + 5.01% of the excess over $28,000

40,000

––

$ 1,536.75 + 6.84% of the excess over $40,000*

* If adjusted gross income is over $250,000 (single), over $300,000 (married, filing

jointly), over $150,000 (married, filing separately),

or over $275,000 (head of household), also use the 2013 Nebraska Additional Tax Rate

Schedule.

8-460-2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4