Page 3

Instructions for completing Form 911 (Rev. 5-2011)

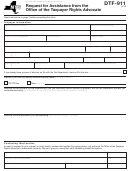

Form 911 Filing Requirements

When to Use this Form: The Taxpayer Advocate Service (TAS) is your voice at the IRS. TAS may be able to help you if you're

experiencing a problem with the IRS and:

• Your problem with the IRS is causing financial difficulties for you, your family or your business;

• You face (or you business is facing) an immediate threat of adverse action; or

• You have tried repeatedly to contact the IRS, but no one has responded, or the IRS has not responded by the date promised.

If an IRS office will not give you the help you've asked for or will not help you in time to avoid harm, you may submit this form. The

Taxpayer Advocate Service will generally ask the IRS to stop certain activities while your request for assistance is pending (for

example, lien filings, levies, and seizures).

Where to Send this Form:

• The quickest method is Fax. TAS has at least one office in every state, the District of Columbia, and Puerto Rico.

Submit this request to the Taxpayer Advocate office in the state or city where you reside. You can find the fax number in the

government listings in your local telephone directory, on our website at , or in Publication 1546,

Taxpayer Advocate Service - Your Voice at the IRS.

• You also can mail this form. You can find the mailing address and phone number (voice) of your local Taxpayer Advocate

office in your phone book, on our website, and in Pub. 1546, or get this information by calling our toll-free number:

1-877-777-4778.

• Are you sending the form from overseas? Fax it to 1-855-818-5697 or mail it to: Taxpayer Advocate Service, Internal

Revenue Service, PO Box 11996, San Juan, Puerto Rico 00922.

• Please be sure to fill out the form completely and submit it to the Taxpayer Advocate office nearest you so we can work your

issue as soon as possible.

What Happens Next?

If you do not hear from us within one week of submitting Form 911, please call the TAS office where you sent your request. You can

find the number at .

Important Notes: Please be aware that by submitting this form, you are authorizing the Taxpayer Advocate Service to contact third

parties as necessary to respond to your request, and you may not receive further notice about these contacts. For more information

see IRC 7602(c).

Caution: The Taxpayer Advocate Service will not consider frivolous arguments raised on this form. You can find examples of frivolous

arguments in Publication 2105, Why do I have to Pay Taxes? If you use this form to raise frivolous arguments, you may be subject to a

penalty of $5,000.

Paperwork Reduction Act Notice: We ask for the information on this form to carry out the Internal Revenue laws of the United

States. Your response is voluntary. You are not required to provide the information requested on a form that is subject to the

Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions

must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax

returns and return information are confidential, as required by Code section 6103. Although the time needed to complete this form may

vary depending on individual circumstances, the estimated average time is 30 minutes.

Should you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, please write to:

Internal Revenue Service, Tax Products Coordinating Committee, Room 6406, 1111 Constitution Ave. NW, Washington, DC 20224.

Instructions for Section I

1a. Enter your name as shown on the tax return that relates to this request for assistance.

1b. Enter your Taxpayer Identifying Number. If you are an individual this will be either a Social Security Number (SSN) or Individual

Taxpayer Identification Number (ITIN). If you are a business entity this will be your Employer Identification Number (EIN) (e.g. a

partnership, corporation, trust or self-employed individual with employees).

2a. Enter your spouse's name (if applicable) if this request relates to a jointly filed return.

2b. Enter your spouse's Taxpayer Identifying Number (SSN or ITIN) if this request relates to a jointly filed return.

3a-d. Enter your current mailing address, including street number and name, city, state, or foreign country, and zip code.

4.

Enter your fax number, including the area code.

5.

Enter your e-mail address. We will only use this to contact you if we are unable to reach you by telephone and your issue appears

to be time sensitive. We will not, however, use your e-mail address to discuss the specifics of your case.

6.

Enter the number of the Federal tax return or form that relates to this request. For example, an individual taxpayer with an income

tax issue would enter Form 1040.

7.

Enter the quarterly, annual, or other tax year or period that relates to this request. For example, if this request involves an income

tax issue, enter the calendar or fiscal year, if an employment tax issue, enter the calendar quarter.

}

Instructions for Section I

continue on the next page

911

Catalog Number 16965S

Form

(Rev. 2-2015)

1

1 2

2 3

3 4

4