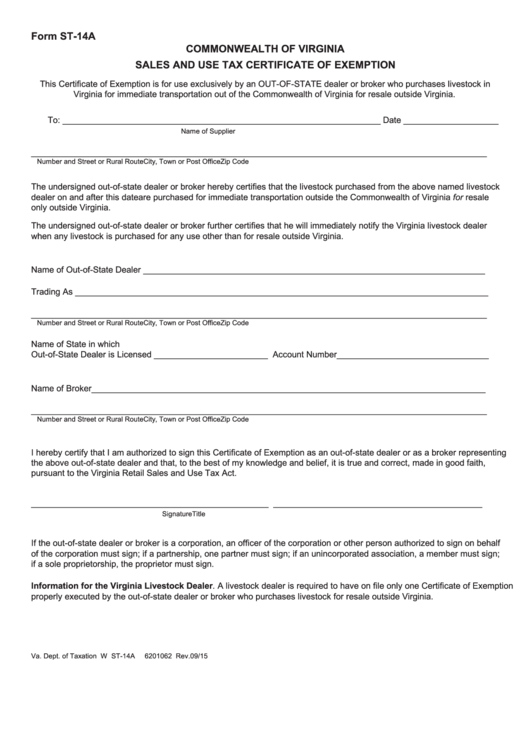

Form ST-14A

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

This Certificate of Exemption is for use exclusively by an OUT-OF-STATE dealer or broker who purchases livestock in

Virginia for immediate transportation out of the Commonwealth of Virginia for resale outside Virginia.

To: ___________________________________________________________________ Date ____________________

Name of Supplier

________________________________________________________________________________________________

Number and Street or Rural Route

City, Town or Post Office

Zip Code

The undersigned out-of-state dealer or broker hereby certifies that the livestock purchased from the above named livestock

dealer on and after this date are purchased for immediate transportation outside the Commonwealth of Virginia for resale

only outside Virginia.

The undersigned out-of-state dealer or broker further certifies that he will immediately notify the Virginia livestock dealer

when any livestock is purchased for any use other than for resale outside Virginia.

Name of Out-of-State Dealer ________________________________________________________________________

Trading As _______________________________________________________________________________________

________________________________________________________________________________________________

Number and Street or Rural Route

City, Town or Post Office

Zip Code

Name of State in which

Out-of-State Dealer is Licensed ________________________ Account Number________________________________

Name of Broker ___________________________________________________________________________________

________________________________________________________________________________________________

Number and Street or Rural Route

City, Town or Post Office

Zip Code

I hereby certify that I am authorized to sign this Certificate of Exemption as an out-of-state dealer or as a broker representing

the above out-of-state dealer and that, to the best of my knowledge and belief, it is true and correct, made in good faith,

pursuant to the Virginia Retail Sales and Use Tax Act.

__________________________________________________

____________________________________________

Signature

Title

If the out-of-state dealer or broker is a corporation, an officer of the corporation or other person authorized to sign on behalf

of the corporation must sign; if a partnership, one partner must sign; if an unincorporated association, a member must sign;

if a sole proprietorship, the proprietor must sign.

Information for the Virginia Livestock Dealer. A livestock dealer is required to have on file only one Certificate of Exemption

properly executed by the out-of-state dealer or broker who purchases livestock for resale outside Virginia.

Va. Dept. of Taxation W ST-14A

6201062

Rev. 09/15

1

1