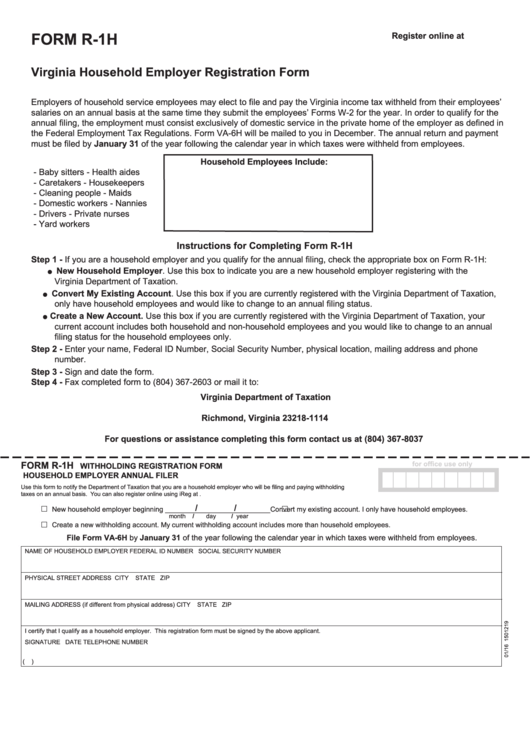

FORM R-1H

Register online at

Virginia Household Employer Registration Form

Employers of household service employees may elect to file and pay the Virginia income tax withheld from their employees’

salaries on an annual basis at the same time they submit the employees’ Forms W-2 for the year. In order to qualify for the

annual filing, the employment must consist exclusively of domestic service in the private home of the employer as defined in

the Federal Employment Tax Regulations. Form VA-6H will be mailed to you in December. The annual return and payment

must be filed by January 31 of the year following the calendar year in which taxes were withheld from employees.

Household Employees Include:

- Baby sitters

- Health aides

- Caretakers

- Housekeepers

- Cleaning people

- Maids

- Domestic workers

- Nannies

- Drivers

- Private nurses

- Yard workers

Instructions for Completing Form R-1H

Step 1 - If you are a household employer and you qualify for the annual filing, check the appropriate box on Form R-1H:

New Household Employer. Use this box to indicate you are a new household employer registering with the

v

Virginia Department of Taxation.

Convert My Existing Account. Use this box if you are currently registered with the Virginia Department of Taxation,

v

only have household employees and would like to change to an annual filing status.

Create a New Account. Use this box if you are currently registered with the Virginia Department of Taxation, your

v

current account includes both household and non-household employees and you would like to change to an annual

filing status for the household employees only.

Step 2 - Enter your name, Federal ID Number, Social Security Number, physical location, mailing address and phone

number.

Step 3 - Sign and date the form.

Step 4 - Fax completed form to (804) 367-2603 or mail it to:

Virginia Department of Taxation

P.O. Box 1114

Richmond, Virginia 23218-1114

For questions or assistance completing this form contact us at (804) 367-8037

FORM R-1H

for office use only

WITHHOLDING REGISTRATION FORM

HOUSEHOLD EMPLOYER ANNUAL FILER

Use this form to notify the Department of Taxation that you are a household employer who will be filing and paying withholding

taxes on an annual basis. You can also register online using iReg at

/

/

New household employer beginning ___________________________

Convert my existing account. I only have household employees.

month

/

day

/ year

Create a new withholding account. My current withholding account includes more than household employees.

File Form VA-6H by January 31 of the year following the calendar year in which taxes were withheld from employees.

NAME OF HOUSEHOLD EMPLOYER

FEDERAL ID NUMBER

SOCIAL SECURITY NUMBER

PHYSICAL STREET ADDRESS

CITY

STATE

ZIP

MAILING ADDRESS (if different from physical address)

CITY

STATE

ZIP

I certify that I qualify as a household employer. This registration form must be signed by the above applicant.

SIGNATURE

DATE

TELEPHONE NUMBER

(

)

1

1