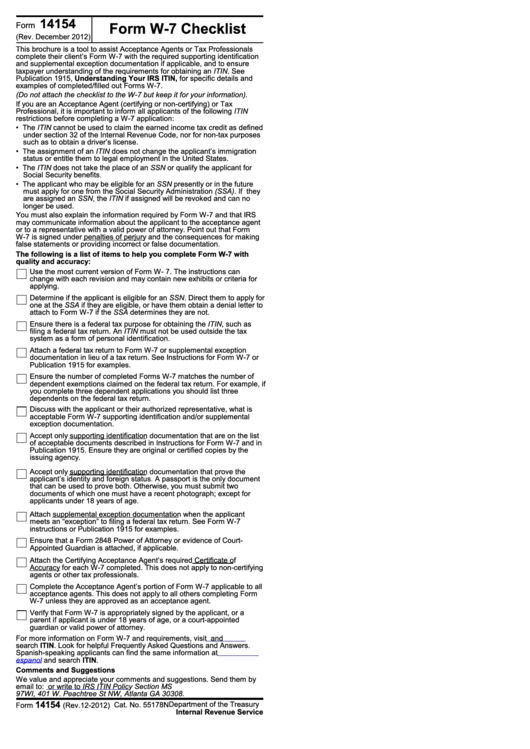

14154

Form W-7 Checklist

Form

(Rev. December 2012)

This brochure is a tool to assist Acceptance Agents or Tax Professionals

complete their client’s Form W-7 with the required supporting identification

and supplemental exception documentation if applicable, and to ensure

taxpayer understanding of the requirements for obtaining an ITIN. See

Publication 1915, Understanding Your IRS ITIN, for specific details and

examples of completed/filled out Forms W-7.

(Do not attach the checklist to the W-7 but keep it for your information).

If you are an Acceptance Agent (certifying or non-certifying) or Tax

Professional, it is important to inform all applicants of the following ITIN

restrictions before completing a W-7 application:

• The ITIN cannot be used to claim the earned income tax credit as defined

under section 32 of the Internal Revenue Code, nor for non-tax purposes

such as to obtain a driver’s license.

• The assignment of an ITIN does not change the applicant’s immigration

status or entitle them to legal employment in the United States.

• The ITIN does not take the place of an SSN or qualify the applicant for

Social Security benefits.

• The applicant who may be eligible for an SSN presently or in the future

must apply for one from the Social Security Administration (SSA). If they

are assigned an SSN, the ITIN if assigned will be revoked and can no

longer be used.

You must also explain the information required by Form W-7 and that IRS

may communicate information about the applicant to the acceptance agent

or to a representative with a valid power of attorney. Point out that Form

W-7 is signed under penalties of perjury and the consequences for making

false statements or providing incorrect or false documentation.

The following is a list of items to help you complete Form W-7 with

quality and accuracy:

Use the most current version of Form W- 7. The instructions can

change with each revision and may contain new exhibits or criteria for

applying.

Determine if the applicant is eligible for an SSN. Direct them to apply for

one at the SSA if they are eligible, or have them obtain a denial letter to

attach to Form W-7 if the SSA determines they are not.

Ensure there is a federal tax purpose for obtaining the ITIN, such as

filing a federal tax return. An ITIN must not be used outside the tax

system as a form of personal identification.

Attach a federal tax return to Form W-7 or supplemental exception

documentation in lieu of a tax return. See Instructions for Form W-7 or

Publication 1915 for examples.

Ensure the number of completed Forms W-7 matches the number of

dependent exemptions claimed on the federal tax return. For example, if

you complete three dependent applications you should list three

dependents on the federal tax return.

Discuss with the applicant or their authorized representative, what is

acceptable Form W-7 supporting identification and/or supplemental

exception documentation.

Accept only supporting identification documentation that are on the list

of acceptable documents described in Instructions for Form W-7 and in

Publication 1915. Ensure they are original or certified copies by the

issuing agency.

Accept only supporting identification documentation that prove the

applicant’s identity and foreign status. A passport is the only document

that can be used to prove both. Otherwise, you must submit two

documents of which one must have a recent photograph; except for

applicants under 18 years of age.

Attach supplemental exception documentation when the applicant

meets an “exception” to filing a federal tax return. See Form W-7

instructions or Publication 1915 for examples.

Ensure that a Form 2848 Power of Attorney or evidence of Court-

Appointed Guardian is attached, if applicable.

Attach the Certifying Acceptance Agent’s required Certificate of

Accuracy for each W-7 completed. This does not apply to non-certifying

agents or other tax professionals.

Complete the Acceptance Agent’s portion of Form W-7 applicable to all

acceptance agents. This does not apply to all others completing Form

W-7 unless they are approved as an acceptance agent.

Verify that Form W-7 is appropriately signed by the applicant, or a

parent if applicant is under 18 years of age, or a court-appointed

guardian or valid power of attorney.

For more information on Form W-7 and requirements, visit

and

search ITIN. Look for helpful Frequently Asked Questions and Answers.

Spanish-speaking applicants can find the same information at

/

espanol

and search ITIN.

Comments and Suggestions

We value and appreciate your comments and suggestions. Send them by

email to:

itinprogramoffice@irs.gov

or write to IRS ITIN Policy Section MS

97WI, 401 W. Peachtree St NW, Atlanta GA 30308.

14154

(Rev.12-2012) Cat. No. 55178N Department of the Treasury

Form

Internal Revenue Service

1

1 2

2