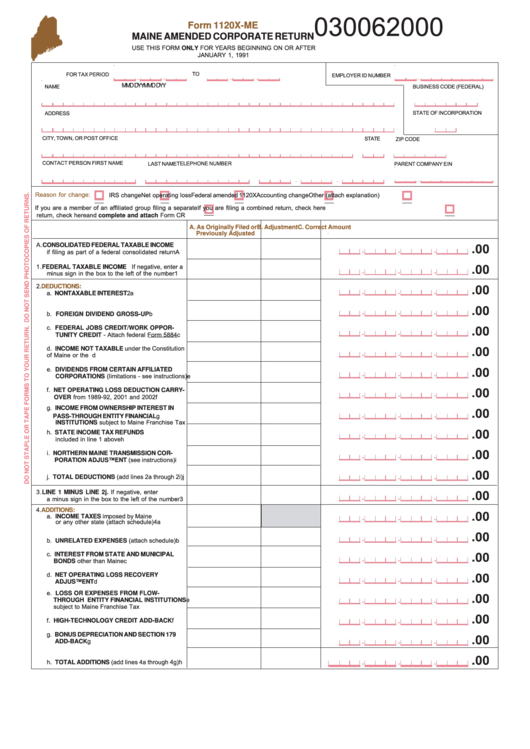

030062000

Form 1120X-ME

MAINE AMENDED CORPORATE RETURN

USE THIS FORM ONLY FOR YEARS BEGINNING ON OR AFTER

JANUARY 1, 1991

TO

FOR TAX PERIOD

EMPLOYER ID NUMBER

-

-

-

-

-

MM

DD

Y Y

MM

DD

Y Y

NAME

BUSINESS CODE (FEDERAL)

ADDRESS

STATE OF INCORPORATION

CITY, TOWN, OR POST OFFICE

STATE

ZIP CODE

CONTACT PERSON FIRST NAME

TELEPHONE NUMBER

LAST NAME

PARENT COMPANY EIN

-

-

-

Reason for change:

IRS change

Net operating loss

Federal amended 1120X

Accounting change

Other (attach explanation)

If you are a member of an affiliated group filing a separate

If you are filing a combined return, check here

return, check here

and complete and attach Form CR

A. As Originally Filed or

B. Adjustment

C. Correct Amount

Previously Adjusted

A. CONSOLIDATED FEDERAL TAXABLE INCOME

.00

if filing as part of a federal consolidated return

A

,

,

,

1. FEDERAL TAXABLE INCOME If negative, enter a

.00

minus sign in the box to the left of the number

1

,

,

,

2.

DEDUCTIONS:

.00

a. NONTAXABLE INTEREST

2a

,

,

,

.00

b. FOREIGN DIVIDEND GROSS-UP

b

,

,

,

c. FEDERAL JOBS CREDIT/WORK OPPOR-

.00

TUNITY CREDIT - Attach federal Form 5884

c

,

,

,

d. INCOME NOT TAXABLE under the Constitution

.00

of Maine or the U.S.

d

,

,

,

e. DIVIDENDS FROM CERTAIN AFFILIATED

.00

CORPORATIONS (limitations - see instructions)

e

,

,

,

f. NET OPERATING LOSS DEDUCTION CARRY-

.00

OVER from 1989-92, 2001 and 2002

f

,

,

,

g. INCOME FROM OWNERSHIP INTEREST IN

.00

g

PASS-THROUGH ENTITY FINANCIAL

,

,

,

INSTITUTIONS subject to Maine Franchise Tax

h. STATE INCOME TAX REFUNDS

.00

included in line 1 above

h

,

,

,

i. NORTHERN MAINE TRANSMISSION COR-

.00

PORATION ADJUSTMENT (see instructions)

i

,

,

,

.00

j. TOTAL DEDUCTIONS (add lines 2a through 2i)

j

,

,

,

3. LINE 1 MINUS LINE 2j. If negative, enter

.00

a minus sign in the box to the left of the number

3

,

,

,

4.

ADDITIONS:

.00

a. INCOME TAXES imposed by Maine

,

,

,

or any other state (attach schedule)

4a

.00

b. UNRELATED EXPENSES (attach schedule)

b

,

,

,

c. INTEREST FROM STATE AND MUNICIPAL

.00

BONDS other than Maine

c

,

,

,

d. NET OPERATING LOSS RECOVERY

.00

d

ADJUSTMENT

,

,

,

e. LOSS OR EXPENSES FROM FLOW-

.00

e

THROUGH ENTITY FINANCIAL INSTITUTIONS

,

,

,

subject to Maine Franchise Tax

.00

f. HIGH-TECHNOLOGY CREDIT ADD-BACK

f

,

,

,

g. BONUS DEPRECIATION AND SECTION 179

.00

g

ADD-BACK

,

,

,

.00

h. TOTAL ADDITIONS (add lines 4a through 4g)

h

,

,

,

1

1 2

2 3

3 4

4