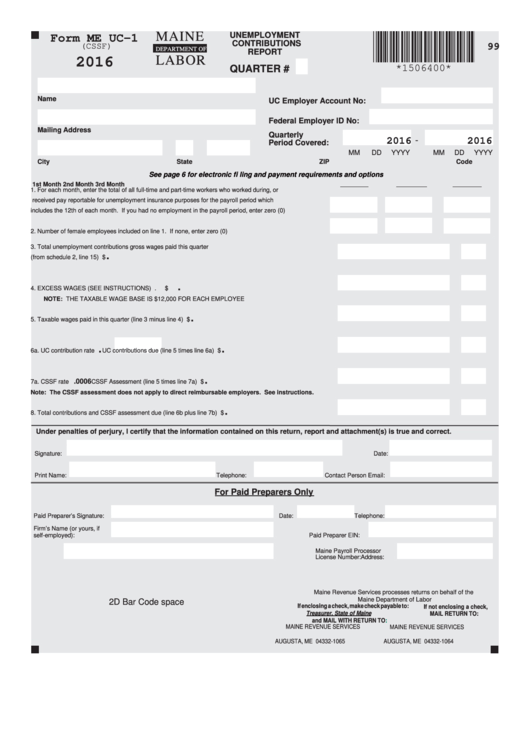

Form Me Uc-1 - Unemployment Contributions Report - 2016

ADVERTISEMENT

MAINE

UNEMPLOYMENT

Form ME UC-1

CONTRIBUTIONS

(CSSF)

99

DEPARTMENT OF

REPORT

LABOR

2016

*1506400*

QUARTER #

Name

UC Employer Account No:

Federal Employer ID No:

Mailing Address

Quarterly

-

2016

2016

Period Covered:

MM

DD

YYYY

MM

DD

YYYY

City

State

ZIP Code

See page 6 for electronic fi ling and payment requirements and options

1st Month

2nd Month

3rd Month

1.

For each month, enter the total of all full-time and part-time workers who worked during, or

received pay reportable for unemployment insurance purposes for the payroll period which

includes the 12th of each month. If you had no employment in the payroll period, enter zero (0) ....... 1.

2.

Number of female employees included on line 1. If none, enter zero (0) ............................................. 2.

3.

Total unemployment contributions gross wages paid this quarter

.

(from schedule 2, line 15) ...................................................................................................................... 3.

$

.

4.

EXCESS WAGES (SEE INSTRUCTIONS) ........................................................................................... 4.

$

NOTE: THE TAXABLE WAGE BASE IS $12,000 FOR EACH EMPLOYEE

.

5.

Taxable wages paid in this quarter (line 3 minus line 4) ........................................................................ 5.

$

.

.

6a. UC contribution rate

UC contributions due (line 5 times line 6a) .............. 6b.

$

.

.0006

7a. CSSF rate

CSSF Assessment (line 5 times line 7a) ........................... 7b.

$

Note: The CSSF assessment does not apply to direct reimbursable employers. See instructions.

.

8.

Total contributions and CSSF assessment due (line 6b plus line 7b) .................................................... 8.

$

Under penalties of perjury, I certify that the information contained on this return, report and attachment(s) is true and correct.

Signature:

Date:

Print Name:

Telephone:

Contact Person Email:

For Paid Preparers Only

Paid Preparer’s Signature:

Date:

Telephone:

Firm’s Name (or yours, if

self-employed):

Paid Preparer EIN:

Maine Payroll Processor

Address:

License Number:

Maine Revenue Services processes returns on behalf of the

Maine Department of Labor

2D Bar Code space

If enclosing a check, make check payable to:

If not enclosing a check,

Treasurer, State of Maine

MAIL RETURN TO:

and MAIL WITH RETURN

TO:

MAINE REVENUE SERVICES

MAINE REVENUE SERVICES

P.O. BOX 1065

P.O. BOX 1064

AUGUSTA, ME 04332-1065

AUGUSTA, ME 04332-1064

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2