Form Gr-4136 - Application For Gasoline Tax Refund - 2000

ADVERTISEMENT

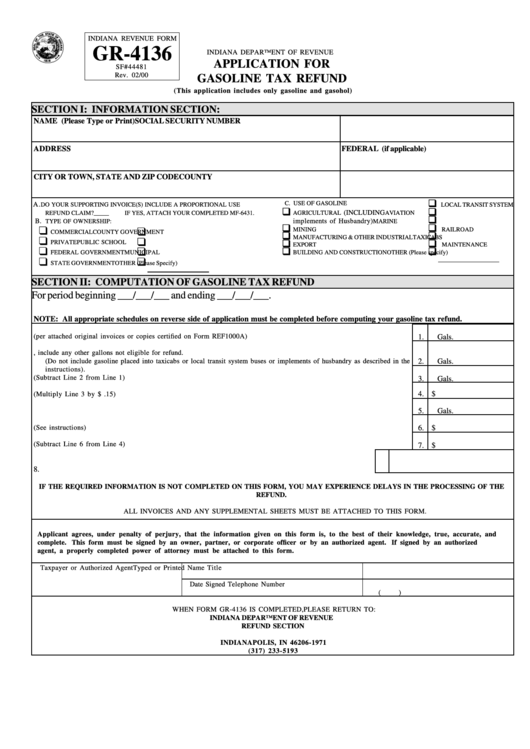

INDIANA REVENUE FORM

GR-4136

INDIANA DEPARTMENT OF REVENUE

APPLICATION FOR

SF#44481

Rev. 02/00

GASOLINE TAX REFUND

(This application includes only gasoline and gasohol)

SECTION I: INFORMATION SECTION:

NAME (Please Type or Print)

SOCIAL SECURITY NUMBER

ADDRESS

FEDERAL I.D. NUMBER (if applicable)

CITY OR TOWN, STATE AND ZIP CODE

COUNTY

G

C. USE OF GASOLINE

A.

DO YOUR SUPPORTING INVOICE(S) INCLUDE A PROPORTIONAL USE

LOCAL TRANSIT SYSTEM

G

G

(INCLUDING

REFUND CLAIM?_____

IF YES, ATTACH YOUR COMPLETED MF-6431.

AGRICULTURAL

AVIATION

G

B.

implements of Husbandry)

TYPE OF OWNERSHIP:

MARINE

G

G

G

G

MINING

RAILROAD

COMMERCIAL

COUNTY GOVERNMENT

G

G

MANUFACTURING & OTHER INDUSTRIAL

TAXICABS

G

G

G

G

PRIVATE

PUBLIC SCHOOL

EXPORT

MAINTENANCE

G

G

G

G

BUILDING AND CONSTRUCTION

OTHER (Please specify)

FEDERAL GOVERNMENT

MUNICIPAL

G

G

STATE GOVERNMENT

OTHER (Please Specify)

SECTION II: COMPUTATION OF GASOLINE TAX REFUND

For period beginning ___/___/___ and ending ___/___/___.

NOTE: All appropriate schedules on reverse side of application must be completed before computing your gasoline tax refund.

1. Enter the total gallons of gasoline purchased (per attached original invoices or copies certified on Form REF1000A) .....

1.

Gals.

2. Enter the total gallons of gasoline placed into licensed vehicles. Also, include any other gallons not eligible for refund.

(Do not include gasoline placed into taxicabs or local transit system buses or implements of husbandry as described in the

2.

Gals.

instructions).

3. Enter total gallons eligible for refund (Subtract Line 2 from Line 1) ..................................................................................

3.

Gals.

4. $

4. Enter the total amount of gasoline tax refund (Multiply Line 3 by $ .15) .........................................................................

5.

Gals.

5. Enter the total number of gallons of gasoline placed into licensed vehicles ......................................................................

6. Enter the amount of Sales Tax due. (See instructions) .....................................................................................................

6. $

7. Enter the amount of refund claimed. (Subtract Line 6 from Line 4) .................................................................................

7. $

8.

8. Enter Sales Tax Account Number ..................................................................................................................................

IF THE REQUIRED INFORMATION IS NOT COMPLETED ON THIS FORM, YOU MAY EXPERIENCE DELAYS IN THE PROCESSING OF THE

REFUND.

ALL INVOICES AND ANY SUPPLEMENTAL SHEETS MUST BE ATTACHED TO THIS FORM.

Applicant agrees, under penalty of perjury, that the information given on this form is, to the best of their knowledge, true, accurate, and

complete. This form must be signed by an owner, partner, or corporate officer or by an authorized agent. If signed by an authorized

agent, a properly completed power of attorney must be attached to this form.

Taxpayer or Authorized Agent

Typed or Printed Name

Title

Date Signed

Telephone Number

(

)

WHEN FORM GR-4136 IS COMPLETED,PLEASE RETURN TO:

INDIANA DEPARTMENT OF REVENUE

REFUND SECTION

P.O. BOX 1971

INDIANAPOLIS, IN 46206-1971

(317) 233-5193

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2