Iowa Mobile/manufactured/modular Home Owner Application For Reduced Tax Rate - 2002

ADVERTISEMENT

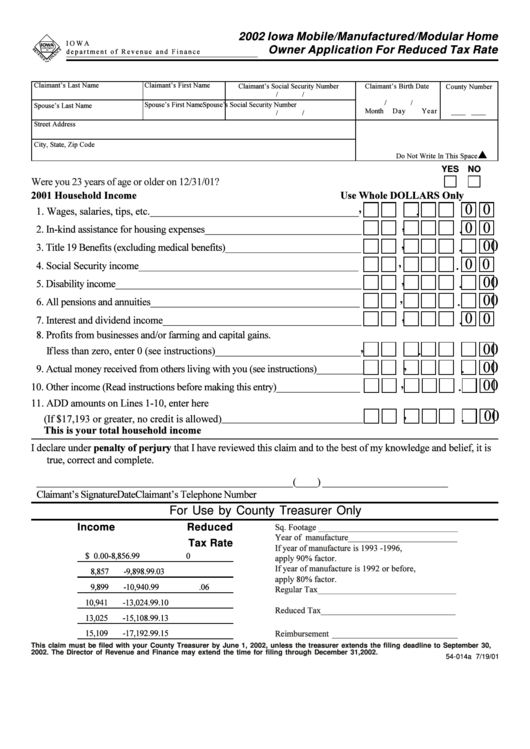

2002 Iowa Mobile/Manufactured/Modular Home

I O WA

Owner Application For Reduced Tax Rate

d e p a r t m e n t o f R e v e n u e a n d F i n a n c e

Claimant’s Last Name

Claimant’s First Name

Claimant’s Social Security Number

Claimant’s Birth Date

County Number

/

/

/

/

Spouse’s First Name

Spouse’s Social Security Number

Spouse’s Last Name

Month

Day

Year

____

____

/

/

Street Address

City, State, Zip Code

p

Do Not Write In This Space

YES NO

2001 Household Income

Use Whole DOLLARS Only

0 0

,

.

0

0

,

.

0

0

,

.

0 0

,

.

0

0

,

.

0

0

,

.

0

0

,

.

0

0

,

.

0

0

,

.

0

0

,

.

0

0

,

.

This is your total household income

penalty of perjury

For Use by County Treasurer Only

Sq. Footage ________________________________

Income

Reduced

Year of manufacture _________________________

Tax Rate

If year of manufacture is 1993 -1996,

$ 0.00

-

8,856.99

0

apply 90% factor.

If year of manufacture is 1992 or before,

8,857

-

9,898.99

.03

apply 80% factor.

9,899

-

10,940.99

.06

Regular Tax ________________________________

10,941

-

13,024.99

.10

Reduced Tax _______________________________

13,025

-

15,108.99

.13

15,109

-

17,192.99

.15

Reimbursement _____________________________

This claim must be filed with your County Treasurer by June 1, 2002, unless the treasurer extends the filing deadline to September 30,

2002. The Director of Revenue and Finance may extend the time for filing through December 31,2002.

54-014a 7/19/01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1