BUREAU OF INDIVIDUAL TAXES

PO BOX 280600

HARRISBURG, PA 17128-0600

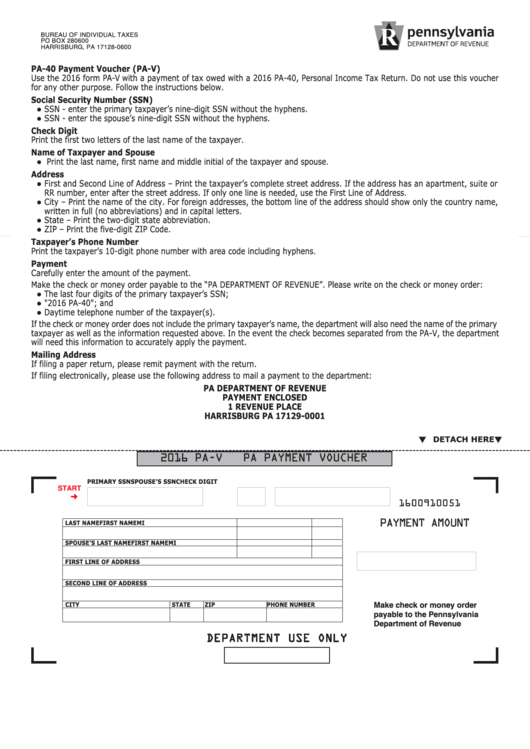

PA-40 Payment Voucher (PA-V)

Use the 2016 form PA-V with a payment of tax owed with a 2016 PA-40, Personal Income Tax Return. Do not use this voucher

for any other purpose. Follow the instructions below.

Social Security Number (SSN)

● SSN - enter the primary taxpayer’s nine-digit SSN without the hyphens.

● SSN - enter the spouse’s nine-digit SSN without the hyphens.

Check Digit

Print the first two letters of the last name of the taxpayer.

Name of Taxpayer and Spouse

● Print the last name, first name and middle initial of the taxpayer and spouse.

Address

● First and Second Line of Address – Print the taxpayer’s complete street address. If the address has an apartment, suite or

RR number, enter after the street address. If only one line is needed, use the First Line of Address.

● City – Print the name of the city. For foreign addresses, the bottom line of the address should show only the country name,

written in full (no abbreviations) and in capital letters.

● State – Print the two-digit state abbreviation.

● ZIP – Print the five-digit ZIP Code.

Taxpayer’s Phone Number

Print the taxpayer’s 10-digit phone number with area code including hyphens.

Payment

Carefully enter the amount of the payment.

Make the check or money order payable to the “PA DEPARTMENT OF REVENUE”. Please write on the check or money order:

● The last four digits of the primary taxpayer’s SSN;

● "2016 PA-40"; and

● Daytime telephone number of the taxpayer(s).

If the check or money order does not include the primary taxpayer’s name, the department will also need the name of the primary

taxpayer as well as the information requested above. In the event the check becomes separated from the PA-V, the department

will need this information to accurately apply the payment.

Mailing Address

If filing a paper return, please remit payment with the return.

If filing electronically, please use the following address to mail a payment to the department:

PA DEPARTMENT OF REVENUE

PAYMENT ENCLOSED

1 REVENUE PLACE

HARRISBURG PA 17129-0001

t

t

DETACH HERE

2016 PA-V

PA PAYMENT VOUCHER

PRIMARY SSN

CHECK DIGIT

SPOUSE’S SSN

START

1600910051

PAYMENT AMOUNT

LAST NAME

FIRST NAME

MI

SPOUSE’S LAST NAME

FIRST NAME

MI

FIRST LINE OF ADDRESS

SECOND LINE OF ADDRESS

CITY

STATE

ZIP

PHONE NUMBER

Make check or money order

payable to the Pennsylvania

Department of Revenue

DEPARTMENT USE ONLY

Reset Entire Form

PRINT

1

1