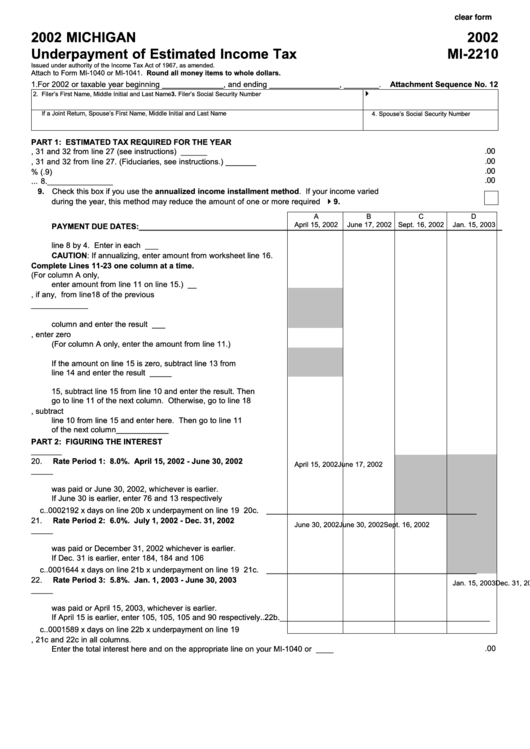

clear form

2002 MICHIGAN

2002

Underpayment of Estimated Income Tax

MI-2210

Issued under authority of the Income Tax Act of 1967, as amended.

Attach to Form MI-1040 or MI-1041. Round all money items to whole dollars.

1. For 2002 or taxable year beginning ______________, and ending ________________, ________.

Attachment Sequence No. 12

4

2. Filer’s First Name, Middle Initial and Last Name

3. Filer’s Social Security Number

If a Joint Return, Spouse’s First Name, Middle Initial and Last Name

4. Spouse’s Social Security Number

PART 1: ESTIMATED TAX REQUIRED FOR THE YEAR

.00

5. Enter 2001 tax. Subtract the sum of MI-1040 lines 30, 31 and 32 from line 27 (see instructions) ............... 5. _______________

6. Enter 2002 tax. Subtract MI-1040 lines 30, 31 and 32 from line 27. (Fiduciaries, see instructions.) ............ 6. _______________

.00

.00

7. Multiply amount on line 6 by 90% (.9) ............................................................................................................ 7. _______________

.00

8. Compare the amount on lines 5 and 7. Enter the smaller number ............................................................... 8. _______________

9. Check this box if you use the annualized income installment method. If your income varied

4

during the year, this method may reduce the amount of one or more required installments .............................................

9.

A

B

C

D

April 15, 2002

June 17, 2002

Sept. 16, 2002

Jan. 15, 2003

PAYMENT DUE DATES: ___________________________________________________________________________________

10.

Required quarterly estimate. Divide the amount on

line 8 by 4. Enter in each column ............................................. 10. ________________________________________________

CAUTION: If annualizing, enter amount from worksheet line 16.

Complete Lines 11-23 one column at a time.

11.

Estimated tax paid and withheld. (For column A only,

enter amount from line 11 on line 15.) ........................................ 11. ________________________________________________

12.

Enter amount, if any, from line 18 of the previous column ........ 12. ________________________________________________

13.

Add lines 11 and 12 ................................................................... 13. ________________________________________________

14.

Add amounts on lines 16 and 17 of the previous

column and enter the result here ............................................... 14. ________________________________________________

15.

Subtract line 14 from line 13. If zero or less, enter zero

(For column A only, enter the amount from line 11.) .................. 15. ________________________________________________

16.

Remaining underpayment from previous period.

If the amount on line 15 is zero, subtract line 13 from

line 14 and enter the result here ................................................ 16. ________________________________________________

17.

UNDERPAYMENT. If line 10 is greater than or equal to line

15, subtract line 15 from line 10 and enter the result. Then

go to line 11 of the next column. Otherwise, go to line 18 ........ 17. ________________________________________________

18.

OVERPAYMENT. If line 15 is greater than line 10, subtract

line 10 from line 15 and enter here. Then go to line 11

of the next column ...................................................................... 18. ________________________________________________

PART 2: FIGURING THE INTEREST

19.

Underpayment from line 17 ....................................................... 19. ________________________________________________

20.

Rate Period 1: 8.0%. April 15, 2002 - June 30, 2002

April 15, 2002

June 17, 2002

a. Computation starting date for this period ................................. 20a. ________________________________________________

b. Number of days from date on line 20a to the date line 19

was paid or June 30, 2002, whichever is earlier.

If June 30 is earlier, enter 76 and 13 respectively ................... 20b. ________________________________________________

c. .0002192 x days on line 20b x underpayment on line 19 ......... 20c. ________________________________________________

21.

Rate Period 2: 6.0%. July 1, 2002 - Dec. 31, 2002

June 30, 2002

June 30, 2002 Sept. 16, 2002

a. Computation starting date for this period ................................. 21a. ________________________________________________

b. Number of days from date on line 21a to the date line 19

was paid or December 31, 2002 whichever is earlier.

If Dec. 31 is earlier, enter 184, 184 and 106 respectively ....... 21b. ________________________________________________

c. .0001644 x days on line 21b x underpayment on line 19 ......... 21c. ________________________________________________

22.

Rate Period 3: 5.8%. Jan. 1, 2003 - June 30, 2003

Dec. 31, 2002

Dec. 31, 2002

Dec. 31, 2002

Jan. 15, 2003

a. Computation starting date for this period ................................. 22a. ________________________________________________

b. Number of days from date on line 22a to the date line 19

was paid or April 15, 2003, whichever is earlier.

If April 15 is earlier, enter 105, 105, 105 and 90 respectively .. 22b. ________________________________________________

c. .0001589 x days on line 22b x underpayment on line 19 ......... 22c.

23.

Interest. Add amount on lines 20c, 21c and 22c in all columns.

Enter the total interest here and on the appropriate line on your MI-1040 or MI-1041 ............................. 23.

_______________

.00

1

1 2

2