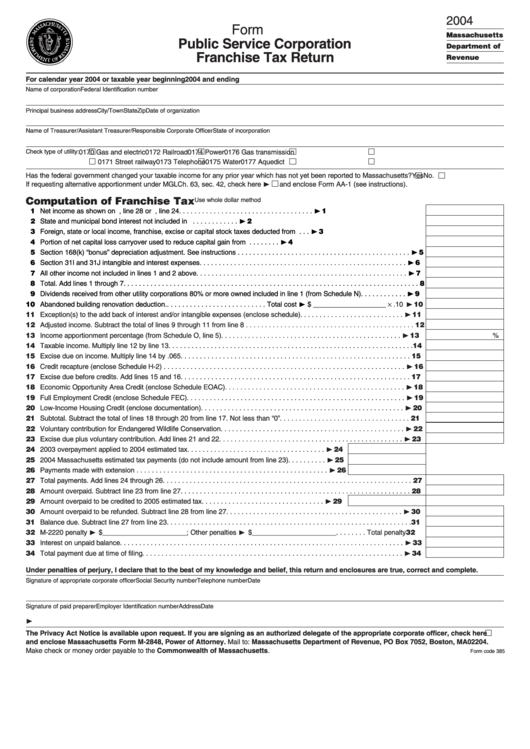

Form P.s.1 - Public Service Corporation Franchise Tax Return - Massachusetts Department Of Revenue - 2004

ADVERTISEMENT

2004

Form P.S.1

Massachusetts

Public Service Corporation

Department of

Franchise Tax Return

Revenue

For calendar year 2004 or taxable year beginning

2004 and ending

Name of corporation

Federal Identification number

Principal business address

City/Town

State

Zip

Date of organization

Name of Treasurer/Assistant Treasurer/Responsible Corporate Officer

State of incorporation

Check type of utility:

0170 Gas and electric

0172 Railroad

0174 Power

0176 Gas transmission

0171 Street railway

0173 Telephone

0175 Water

0177 Aquedict

Has the federal government changed your taxable income for any prior year which has not yet been reported to Massachusetts?

Yes

No.

If requesting alternative apportionment under MGL Ch. 63, sec. 42, check here ❿

and enclose Form AA-1 (see instructions).

Computation of Franchise Tax

Use whole dollar method

11 Net income as shown on U.S. Form 1120, line 28 or U.S. Form 1120A, line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 1

12 State and municipal bond interest not included in U.S. net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 2

13 Foreign, state or local income, franchise, excise or capital stock taxes deducted from U.S. net income . . . . . . . . . . . . . . . . ❿ 3

14 Portion of net capital loss carryover used to reduce capital gain from U.S. Schedule D. . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 4

15 Section 168(k) “bonus” depreciation adjustment. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 5

16 Section 31I and 31J intangible and interest expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 6

17 All other income not included in lines 1 and 2 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 7

18 Total. Add lines 1 through 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Dividends received from other utility corporations 80% or more owned included in line 1 (from Schedule N) . . . . . . . . . . . . ❿ 9

× .10 ❿ 10

10 Abandoned building renovation deduction.. . . . . . . . . . . . . . . . . . . . . . . . . . Total cost ❿ $ ___________________

11 Exception(s) to the add back of interest and/or intangible expenses (enclose schedule). . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 11

12 Adjusted income. Subtract the total of lines 9 through 11 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Income apportionment percentage (from Schedule O, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 13

%

14 Taxable income. Multiply line 12 by line 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Excise due on income. Multiply line 14 by .065 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Credit recapture (enclose Schedule H-2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 16

17 Excise due before credits. Add lines 15 and 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Economic Opportunity Area Credit (enclose Schedule EOAC). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 18

19 Full Employment Credit (enclose Schedule FEC). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 19

20 Low-Income Housing Credit (enclose documentation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 20

21 Subtotal. Subtract the total of lines 18 through 20 from line 17. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Voluntary contribution for Endangered Wildlife Conservation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 22

23 Excise due plus voluntary contribution. Add lines 21 and 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 23

24 2003 overpayment applied to 2004 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 24

25 2004 Massachusetts estimated tax payments (do not include amount from line 23) . . . . . . . . . . ❿ 25

26 Payments made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 26

27 Total payments. Add lines 24 through 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Amount overpaid. Subtract line 23 from line 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 Amount overpaid to be credited to 2005 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 29

30 Amount overpaid to be refunded. Subtract line 28 from line 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 30

31 Balance due. Subtract line 27 from line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 M-2220 penalty ❿ $ ______________________ ; Other penalties ❿ $ ______________________ . . . . . . . . Total penalty 32

33 Interest on unpaid balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 33

34 Total payment due at time of filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 34

Under penalties of perjury, I declare that to the best of my knowledge and belief, this return and enclosures are true, correct and complete.

Signature of appropriate corporate officer

Social Security number

Telephone number

Date

Signature of paid preparer

Employer Identification number

Address

Date

❿

The Privacy Act Notice is available upon request. If you are signing as an authorized delegate of the appropriate corporate officer, check here

and enclose Massachusetts Form M-2848, Power of Attorney. Mail to: Massachusetts Department of Revenue, PO Box 7052, Boston, MA 02204.

Make check or money order payable to the Commonwealth of Massachusetts.

Form code 385

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2