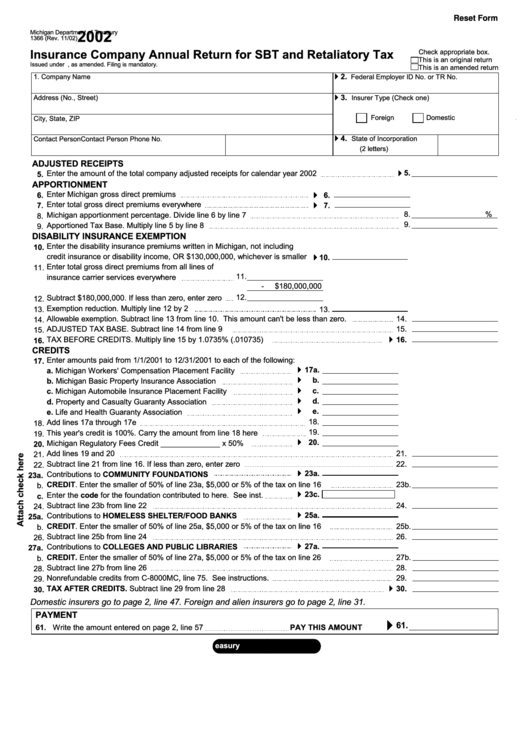

Form 1366 - Insurance Company Annual Return For Sbt And Retaliatory Tax - 2002

ADVERTISEMENT

Reset Form

2002

Michigan Department of Treasury

1366 (Rev. 11/02)

Insurance Company Annual Return for SBT and Retaliatory Tax

Check appropriate box.

This is an original return

Issued under P.A. 228 of 1975, as amended. Filing is mandatory.

This is an amended return

4

2.

1. Company Name

Federal Employer ID No. or TR No.

4

3.

Address (No., Street)

Insurer Type (Check one)

Foreign

Domestic

City, State, ZIP

4

4.

State of Incorporation

Contact Person

Contact Person Phone No.

(2 letters)

ADJUSTED RECEIPTS

4

5.

Enter the amount of the total company adjusted receipts for calendar year 2002

5.

APPORTIONMENT

4

Enter Michigan gross direct premiums

6.

6.

4

Enter total gross direct premiums everywhere

7.

7.

8.

%

Michigan apportionment percentage. Divide line 6 by line 7

8.

9.

Apportioned Tax Base. Multiply line 5 by line 8

9.

DISABILITY INSURANCE EXEMPTION

Enter the disability insurance premiums written in Michigan, not including

10.

4

credit insurance or disability income, OR $130,000,000, whichever is smaller

10.

Enter total gross direct premiums from all lines of

11.

11.

insurance carrier services everywhere

-

$180,000,000

12.

Subtract $180,000,000. If less than zero, enter zero

12.

Exemption reduction. Multiply line 12 by 2

13.

13.

Allowable exemption. Subtract line 13 from line 10. This amount can't be less than zero.

14.

14.

ADJUSTED TAX BASE. Subtract line 14 from line 9

15.

15.

4

TAX BEFORE CREDITS. Multiply line 15 by 1.0735% (.010735)

16.

16.

CREDITS

Enter amounts paid from 1/1/2001 to 12/31/2001 to each of the following:

17.

4

17a.

a. Michigan Workers' Compensation Placement Facility

4

b.

b. Michigan Basic Property Insurance Association

4

c.

c. Michigan Automobile Insurance Placement Facility

4

d.

d. Property and Casualty Guaranty Association

4

e.

e. Life and Health Guaranty Association

18.

Add lines 17a through 17e

18.

19.

This year's credit is 100%. Carry the amount from line 18 here

19.

4

20.

Michigan Regulatory Fees Credit ______________ x 50%

20.

Add lines 19 and 20

21.

21.

Subtract line 21 from line 16. If less than zero, enter zero

22.

22.

4

23a.

Contributions to COMMUNITY FOUNDATIONS

23a.

CREDIT. Enter the smaller of 50% of line 23a, $5,000 or 5% of the tax on line 16

23b.

b.

4

23c.

Enter the code for the foundation contributed to here. See inst.

c.

Subtract line 23b from line 22

24.

24.

4

25a.

Contributions to HOMELESS SHELTER/FOOD BANKS

25a.

CREDIT. Enter the smaller of 50% of line 25a, $5,000 or 5% of the tax on line 16

25b.

b.

Subtract line 25b from line 24

26.

26.

4

27a.

Contributions to COLLEGES AND PUBLIC LIBRARIES

27a.

CREDIT. Enter the smaller of 50% of line 27a, $5,000 or 5% of the tax on line 26

27b.

b.

Subtract line 27b from line 26

28.

28.

Nonrefundable credits from C-8000MC, line 75. See instructions.

29.

29.

4

TAX AFTER CREDITS. Subtract line 29 from line 28

30.

30.

Domestic insurers go to page 2, line 47. Foreign and alien insurers go to page 2, line 31.

PAYMENT

4

61.

61. Write the amount entered on page 2, line 57

PAY THIS AMOUNT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2