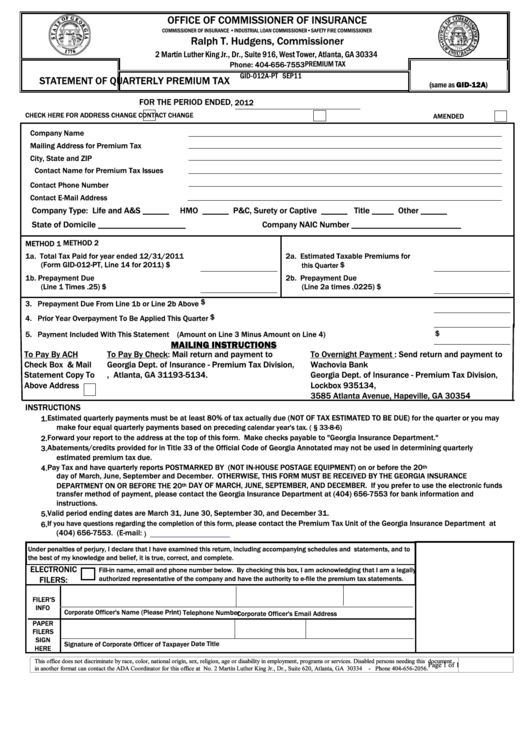

Form Gid-012a-Pt - Statement Of Quarterly Premium Tax - Georgia Insurance Department - 2012

ADVERTISEMENT

OFFICE OF COMMISSIONER OF INSURANCE

COMMISSIONER OF INSURANCE •INDUSTRIAL LOAN COMMISSIONER•SAFETY FIRE COMMISSIONER

Ralph T. Hudgens, Commissioner

2 Martin Luther King Jr., Dr., Suite 916, West Tower, Atlanta, GA 30334

PREMIUM TAX

Phone: 404-656-7553

GID-012A-PT SEP11

STATEMENT OF QUARTERLY PREMIUM TAX

(same as GID-12A)

FOR THE PERIOD ENDED

, 2012

CHECK HERE FOR ADDRESS CHANGE

CONTACT CHANGE

AMENDED

Company Name

Mailing Address for Premium Tax

City, State and ZIP

Contact Name for Premium Tax Issues

Contact Phone Number

Contact E-Mail Address

Company Type: Life and A&S ______

HMO ______ P&C, Surety or Captive ______ Title _____ Other ______

State of Domicile ____________________

Company NAIC Number _________________________

METHOD 2

METHOD 1

1a. Total Tax Paid for year ended 12/31/2011

2a. Estimated Taxable Premiums for

(Form GID-012-PT, Line 14 for 2011)

$

$

this Quarter

1b. Prepayment Due

2b. Prepayment Due

(Line 1 Times .25)

$

(Line 2a times .0225)

$

$

3. Prepayment Due From Line 1b or Line 2b Above

$

4. Prior Year Overpayment To Be Applied This Quarter

$

5. Payment Included With This Statement (Amount on Line 3 Minus Amount on Line 4)

MAILING INSTRUCTIONS

To Pay By ACH

To Pay By Check: Mail return and payment to

To Overnight Payment : Send return and payment to

Check Box & Mail

Georgia Dept. of Insurance - Premium Tax Division,

Wachovia Bank

Statement Copy To

P.O. Box 935134, Atlanta, GA 31193-5134.

Georgia Dept. of Insurance - Premium Tax Division,

Above Address

Lockbox 935134,

3585 Atlanta Avenue, Hapeville, GA 30354

INSTRUCTIONS

Estimated quarterly payments must be at least 80% of tax actually due (NOT OF TAX ESTIMATED TO BE DUE) for the quarter or you may

1.

make four equal quarterly payments based on prec

eding calendar year's tax. (O.C.G.A. § 33-8-6)

Forward your report to the address at the top of this form. Make checks payable to "Georgia Insurance Department."

2.

Abatements/credits provided for in Title 33 of the Official Code of Georgia Annotated may not be used in determining quarterly

3.

estimated premium tax due.

Pay Tax and have quarterly reports POSTMARKED BY U.S. POSTAL SERVICE (NOT IN-HOUSE POSTAGE EQUIPMENT) on or before the 20

4.

th

day of March, June, September and December. OTHERWISE, THIS FORM MUST BE RECEIVED BY THE GEORGIA INSURANCE

DEPARTMENT ON OR BEFORE THE 20

DAY OF MARCH, JUNE, SEPTEMBER, AND DECEMBER. If you prefer to use the electronic funds

th

transfer method of payment, please contact the Georgia Insurance Department at (404) 656-7553 for bank information and

instructions.

Valid period ending dates are March 31, June 30, September 30, and December 31.

5.

If you have questions regarding the completion of this form, plea

se contact the Premium Tax Unit of the Georgia Insurance Department at

6.

(404) 656-7553. (E-mail:

premiumtax@oci.ga.gov

)

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to

the best of my knowledge and belief, it is true, correct, and complete.

ELECTRONIC

Fill-in name, email and phone number below. By checking this box, I am acknowledging that I am a legally

FILERS:

authorized representative of the company and have the authority to e-file the premium tax statements.

FILER'S

INFO

Corporate Officer's Name (Please Print)

Telephone Number

Corporate Officer's Email Address

PAPER

FILERS

SIGN

Date

Title

Signature of Corporate Officer of Taxpayer

HERE

This office does not discriminate by race, color, national origin, sex, religion, age or disability in employment, programs or services. Disabled persons needing this document

Page 1 of 1

in another format can contact the ADA Coordinator for this office at No. 2 Martin Luther King Jr., Dr., Suite 620, Atlanta, GA 30334 - Phone 404-656-2056.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1