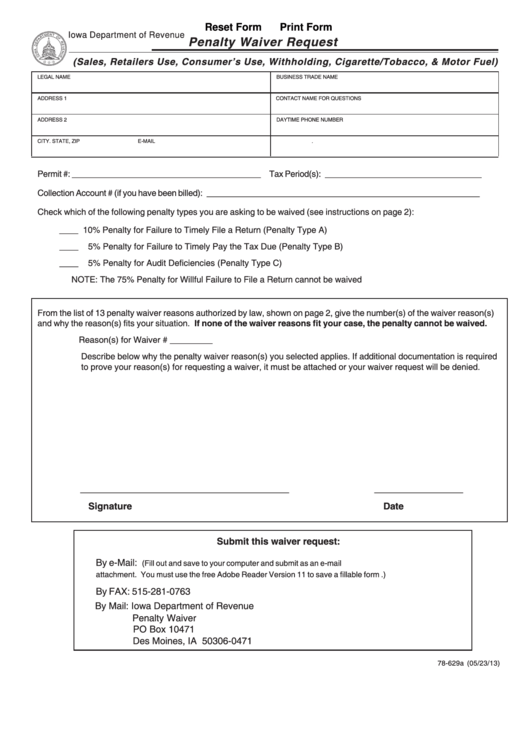

Reset Form

Print Form

Iowa Department of Revenue

Penalty Waiver Request

(Sales, Retailers Use, Consumer’s Use, Withholding, Cigarette/Tobacco, & Motor Fuel)

LEGAL NAME

BUSINESS TRADE NAME

ADDRESS 1

CONTACT NAME FOR QUESTIONS

ADDRESS 2

DAYTIME PHONE NUMBER

CITY. STATE, ZIP

E-MAIL

.

Permit #: _________________________________________ Tax Period(s): __________________________________

Collection Account # (if you have been billed): ___________________________________________________________

Check which of the following penalty types you are asking to be waived (see instructions on page 2):

____ 10% Penalty for Failure to Timely File a Return (Penalty Type A)

____

5% Penalty for Failure to Timely Pay the Tax Due (Penalty Type B)

____

5% Penalty for Audit Deficiencies (Penalty Type C)

NOTE: The 75% Penalty for Willful Failure to File a Return cannot be waived

From the list of 13 penalty waiver reasons authorized by law, shown on page 2, give the number(s) of the waiver reason(s)

and why the reason(s) fits your situation. If none of the waiver reasons fit your case, the penalty cannot be waived.

Reason(s) for Waiver # _________

Describe below why the penalty waiver reason(s) you selected applies. If additional documentation is required

to prove your reason(s) for requesting a waiver, it must be attached or your waiver request will be denied.

________________________________________

_________________

Signature

Date

Submit this waiver request:

By e-Mail: Dennis.kyle@iowa.gov

(Fill out and save to your computer and submit as an e-mail

attachment. You must use the free Adobe Reader Version 11 to save a fillable form .)

By FAX: 515-281-0763

By Mail: Iowa Department of Revenue

Penalty Waiver

PO Box 10471

Des Moines, IA 50306-0471

78-629a (05/23/13)

1

1 2

2