Individual Tax Return - Wyoming Income Tax Department - 2011

ADVERTISEMENT

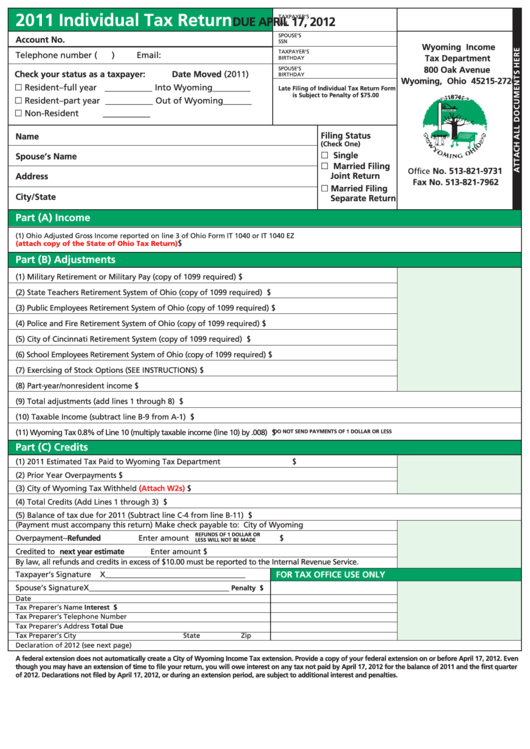

2011 Individual Tax Return

TAXPAYER’S

DUE APRIL 17, 2012

SSN

SPOUSE’S

Account No.

SSN

Wyoming Income

TAXPAYER’S

Telephone number (

)

Email:

Tax Department

BIRTHDAY

800 Oak Avenue

SPOUSE’S

Check your status as a taxpayer:

Date Moved (2011)

BIRTHDAY

Wyoming, Ohio 45215-2720

__________

________

Resident–full year

Into Wyoming

Late Filing of Individual Tax Return Form

is Subject to Penalty of $75.00

__________

______

Resident–part year

Out of Wyoming

__________

Non-Resident

Filing Status

Name

(Check One)

Single

Spouse’s Name

Married Filing

No. 513-821-9731

Joint Return

Address

Fax No. 513-821-7962

Married Filing

City/State

Separate Return

Part (A) Income

(1) Ohio Adjusted Gross Income reported on line 3 of Ohio Form IT 1040 or IT 1040 EZ

$

(attach copy of the State of Ohio Tax

Return).................................see instructions

Part (B) Adjustments

(1) Military Retirement or Military Pay (copy of 1099 required)

$

(2) State Teachers Retirement System of Ohio (copy of 1099 required)

$

(3) Public Employees Retirement System of Ohio (copy of 1099 required) $

(4) Police and Fire Retirement System of Ohio (copy of 1099 required)

$

(5) City of Cincinnati Retirement System (copy of 1099 required)

$

(6) School Employees Retirement System of Ohio (copy of 1099 required)

$

(7) Exercising of Stock Options (SEE INSTRUCTIONS)

$

(8) Part-year/nonresident income

$

(9) Total adjustments (add lines 1 through 8)

$

(10) Taxable Income (subtract line B-9 from A-1)

$

(11) Wyoming Tax 0.8% of Line 10 (multiply taxable income (line 10) by .008)

$

DO NOT SEND PAYMENTS OF 1 DOLLAR OR LESS

Part (C) Credits

(1) 2011 Estimated Tax Paid to Wyoming Tax Department

$

(2) Prior Year Overpayments

$

(3) City of Wyoming Tax Withheld

(Attach W2s)

$

(4) Total Credits (Add Lines 1 through 3)

$

(5) Balance of tax due for 2011 (Subtract line C-4 from line B-11)

$

(Payment must accompany this return) Make check payable to: City of Wyoming

REFUNDS OF 1 DOLLAR OR

Overpayment--Refunded

Enter amount

$

LESS WILL NOT BE MADE

Credited to next year estimate

Enter amount

$

By law, all refunds and credits in excess of $10.00 must be reported to the Internal Revenue Service.

FOR TAX OFFICE USE ONLY

Taxpayer’s Signature

X____________________________________

Spouse’s Signature

X____________________________________

Penalty $

Date

Tax Preparer’s Name

Interest $

Tax Preparer’s Telephone Number

Tax Preparer’s Address

Total Due

Tax Preparer’s City

State

Zip

Declaration of 2012 (see next page)

A federal extension does not automatically create a City of Wyoming Income Tax extension. Provide a copy of your federal extension on or before April 17, 2012. Even

though you may have an extension of time to file your return, you will owe interest on any tax not paid by April 17, 2012 for the balance of 2011 and the first quarter

of 2012. Declarations not filed by April 17, 2012, or during an extension period, are subject to additional interest and penalties.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2