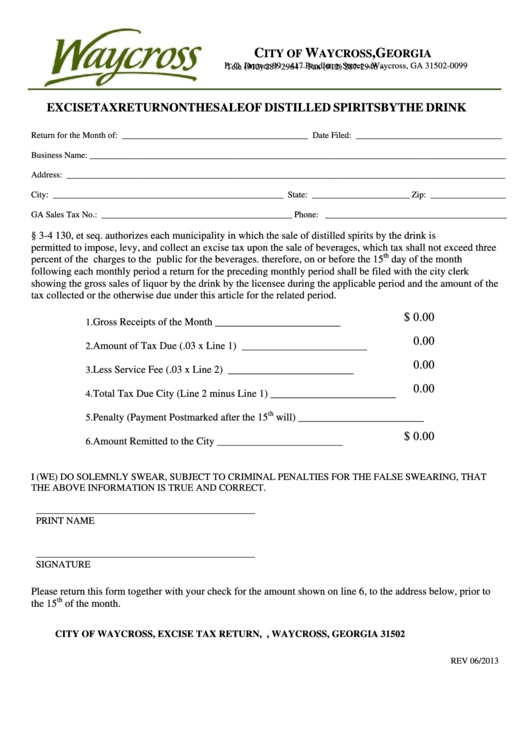

C

W

, G

ITY OF

AYCROSS

EORGIA

P. O. Drawer 99 – 417 Pendleton Street – Waycross, GA 31502-0099

Tele (912) 287-2964 – Fax (912) 287-2946 –

EXCISE TAX RETURN ON THE SALE OF DISTILLED SPIRITS BY THE DRINK

Return for the Month of: __________________________________________ Date Filed: _________________________________

Business Name: ______________________________________________________________________________________________

Address: ___________________________________________________________________________________________________

City: ____________________________________________________ State: ______________________ Zip: _________________

GA Sales Tax No.: ___________________________________________ Phone: _________________________________________

O.C.G.A. § 3-4 130, et seq. authorizes each municipality in which the sale of distilled spirits by the drink is

permitted to impose, levy, and collect an excise tax upon the sale of beverages, which tax shall not exceed three

th

percent of the charges to the public for the beverages. therefore, on or before the 15

day of the month

following each monthly period a return for the preceding monthly period shall be filed with the city clerk

showing the gross sales of liquor by the drink by the licensee during the applicable period and the amount of the

tax collected or the otherwise due under this article for the related period.

$ 0.00

Gross Receipts of the Month

________________________

1.

0.00

Amount of Tax Due (.03 x Line 1)

________________________

2.

0.00

Less Service Fee (.03 x Line 2)

________________________

3.

0.00

Total Tax Due City (Line 2 minus Line 1)

________________________

4.

th

Penalty (Payment Postmarked after the 15

will) ________________________

5.

$ 0.00

Amount Remitted to the City

________________________

6.

I (WE) DO SOLEMNLY SWEAR, SUBJECT TO CRIMINAL PENALTIES FOR THE FALSE SWEARING, THAT

THE ABOVE INFORMATION IS TRUE AND CORRECT.

_____________________________________________

PRINT NAME

_____________________________________________

SIGNATURE

Please return this form together with your check for the amount shown on line 6, to the address below, prior to

th

the 15

of the month.

CITY OF WAYCROSS, EXCISE TAX RETURN, P.O. DRAWER 99, WAYCROSS, GEORGIA 31502

REV 06/2013

1

1