Form Crs-1 - Combined Report Form - 2016

ADVERTISEMENT

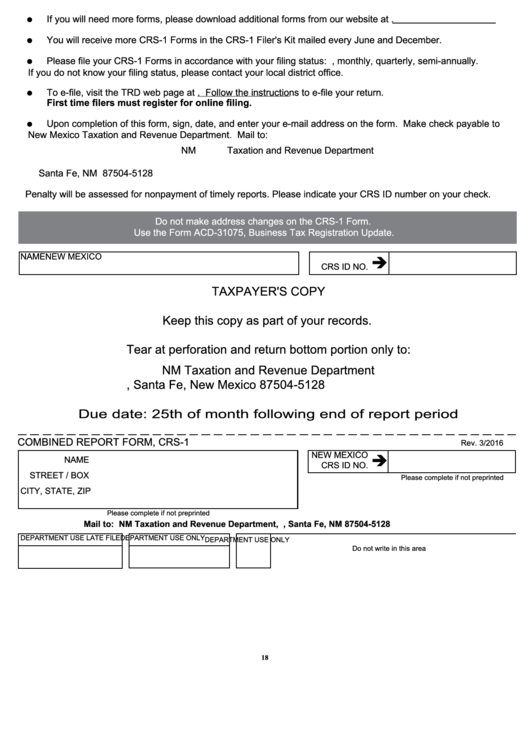

If you will need more forms, please download additional forms from our website at

You will receive more CRS-1 Forms in the CRS-1 Filer's Kit mailed every June and December.

Please file your CRS-1 Forms in accordance with your filing status: i.e., monthly, quarterly, semi-annually.

If you do not know your filing status, please contact your local district office.

To e-file, visit the TRD web page at https://tap.state.nm.us. Follow the instructions to e-file your return.

First time filers must register for online filing.

Upon completion of this form, sign, date, and enter your e-mail address on the form. Make check payable to

New Mexico Taxation and Revenue Department. Mail to:

NM Taxation and Revenue Department

P.O. Box 25128

Santa Fe, NM 87504-5128

Penalty will be assessed for nonpayment of timely reports. Please indicate your CRS ID number on your check.

Do not make address changes on the CRS-1 Form.

Use the Form ACD-31075, Business Tax Registration Update.

NAME

NEW MEXICO

CRS ID NO.

TAXPAYER'S COPY

Keep this copy as part of your records.

Tear at perforation and return bottom portion only to:

NM Taxation and Revenue Department

P.O. Box 25128, Santa Fe, New Mexico 87504-5128

Due date: 25th of month following end of report period

COMBINED REPORT FORM, CRS-1

Rev. 3/2016

NEW MEXICO

NAME

CRS ID NO.

STREET / BOX

Please complete if not preprinted

CITY, STATE, ZIP

Please complete if not preprinted

Mail to: NM Taxation and Revenue Department, P.O. Box 25128, Santa Fe, NM 87504-5128

DEPARTMENT USE LATE FILE

DEPARTMENT USE ONLY

DEPARTMENT USE ONLY

Do not write in this area

18

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2