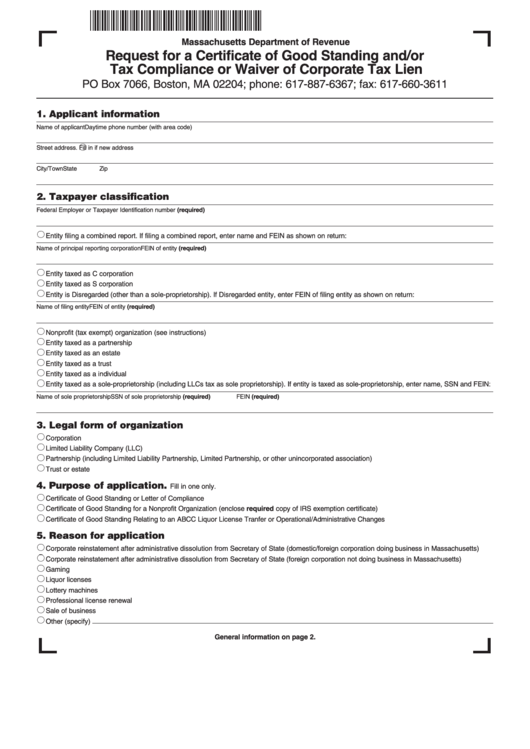

Request For A Certificate Of Good Standing And/or Tax Compliance Or Waiver Of Corporate Tax Lien - Massachusetts Department Of Revenue

ADVERTISEMENT

Massachusetts Department of Revenue

Request for a Certificate of Good Standing and/or

Tax Compliance or Waiver of Corporate Tax Lien

PO Box 7066, Boston, MA 02204; phone: 617-887-6367; fax: 617-660-3611

1. Applicant information

Name of applicant

Daytime phone number (with area code)

Street address.

Fill in if new address

City/Town

State

Zip

2. Taxpayer classification

Federal Employer or Taxpayer Identification number (required)

Entity filing a combined report. If filing a combined report, enter name and FEIN as shown on return:

Name of principal reporting corporation

FEIN of entity (required)

Entity taxed as C corporation

Entity taxed as S corporation

Entity is Disregarded (other than a sole-proprietorship). If Disregarded entity, enter FEIN of filing entity as shown on return:

Name of filing entity

FEIN of entity (required)

Nonprofit (tax exempt) organization (see instructions)

Entity taxed as a partnership

Entity taxed as an estate

Entity taxed as a trust

Entity taxed as a individual

Entity taxed as a sole-proprietorship (including LLCs tax as sole proprietorship). If entity is taxed as sole-proprietorship, enter name, SSN and FEIN:

Name of sole proprietorship

SSN of sole proprietorship (required)

FEIN (required)

3. Legal form of organization

Corporation

Limited Liability Company (LLC)

Partnership (including Limited Liability Partnership, Limited Partnership, or other unincorporated association)

Trust or estate

4. Purpose of application.

Fill in one only.

Certificate of Good Standing or Letter of Compliance

Certificate of Good Standing for a Nonprofit Organization (enclose required copy of IRS exemption certificate)

Certificate of Good Standing Relating to an ABCC Liquor License Tranfer or Operational/Administrative Changes

5. Reason for application

Corporate reinstatement after administrative dissolution from Secretary of State (domestic/foreign corporation doing business in Massachusetts)

Corporate reinstatement after administrative dissolution from Secretary of State (foreign corporation not doing business in Massachusetts)

Gaming

Liquor licenses

Lottery machines

Professional license renewal

Sale of business

Other (specify)

General information on page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2