Instructions For Form 200-01/200-03 Ez - Resident Individual Income Tax Return

ADVERTISEMENT

Form 200-01/200-03 EZ

RESIDENT INDIVIDUAL INCOME TAX RETURN

GENERAL INSTRUCTIONS

Who Must File

Who is a Resident

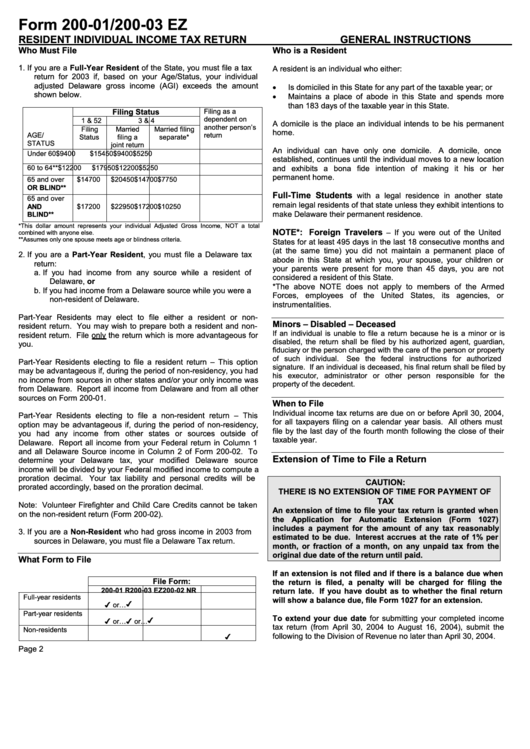

1.

If you are a Full-Year Resident of the State, you must file a tax

A resident is an individual who either:

return for 2003 if, based on your Age/Status, your individual

adjusted Delaware gross income (AGI) exceeds the amount

•

Is domiciled in this State for any part of the taxable year; or

shown below.

•

Maintains a place of abode in this State and spends more

than 183 days of the taxable year in this State.

Filing Status

Filing as a

dependent on

1 & 5

2

3 & 4

A domicile is the place an individual intends to be his permanent

another person’s

Filing

Married

Married filing

home.

AGE/

return

Status

filing a

separate*

STATUS

joint return

An individual can have only one domicile.

A domicile, once

Under 60

$9400

$15450

$9400

$5250

established, continues until the individual moves to a new location

60 to 64**

$12200

$17950

$12200

$5250

and exhibits a bona fide intention of making it his or her

permanent home.

65 and over

$14700

$20450

$14700

$7750

OR BLIND**

Full-Time Students

with a legal residence in another state

65 and over

remain legal residents of that state unless they exhibit intentions to

AND

$17200

$22950

$17200

$10250

make Delaware their permanent residence.

BLIND**

*This dollar amount represents your individual Adjusted Gross Income, NOT a total

NOTE*: Foreign Travelers

– If you were out of the United

combined with anyone else.

**Assumes only one spouse meets age or blindness criteria.

States for at least 495 days in the last 18 consecutive months and

(at the same time) you did not maintain a permanent place of

2.

If you are a Part-Year Resident, you must file a Delaware tax

abode in this State at which you, your spouse, your children or

return:

your parents were present for more than 45 days, you are not

a.

If you had income from any source while a resident of

considered a resident of this State.

Delaware, or

*The above NOTE does not apply to members of the Armed

b.

If you had income from a Delaware source while you were a

Forces, employees of the United States, its agencies, or

non-resident of Delaware.

instrumentalities.

Part-Year Residents may elect to file either a resident or non-

Minors – Disabled – Deceased

resident return. You may wish to prepare both a resident and non-

If an individual is unable to file a return because he is a minor or is

resident return. File only the return which is more advantageous for

disabled, the return shall be filed by his authorized agent, guardian,

you.

fiduciary or the person charged with the care of the person or property

of such individual.

See the federal instructions for authorized

Part-Year Residents electing to file a resident return – This option

signature. If an individual is deceased, his final return shall be filed by

may be advantageous if, during the period of non-residency, you had

his executor, administrator or other person responsible for the

no income from sources in other states and/or your only income was

property of the decedent.

from Delaware. Report all income from Delaware and from all other

sources on Form 200-01.

When to File

Individual income tax returns are due on or before April 30, 2004,

Part-Year Residents electing to file a non-resident return – This

for all taxpayers filing on a calendar year basis. All others must

option may be advantageous if, during the period of non-residency,

file by the last day of the fourth month following the close of their

you had any income from other states or sources outside of

taxable year.

Delaware. Report all income from your Federal return in Column 1

and all Delaware Source income in Column 2 of Form 200-02. To

Extension of Time to File a Return

determine your Delaware tax, your modified Delaware source

income will be divided by your Federal modified income to compute a

proration decimal.

Your tax liability and personal credits will be

CAUTION:

prorated accordingly, based on the proration decimal.

THERE IS NO EXTENSION OF TIME FOR PAYMENT OF

TAX

Note: Volunteer Firefighter and Child Care Credits cannot be taken

An extension of time to file your tax return is granted when

on the non-resident return (Form 200-02).

the Application for Automatic Extension (Form 1027)

includes a payment for the amount of any tax reasonably

3.

If you are a Non-Resident who had gross income in 2003 from

estimated to be due. Interest accrues at the rate of 1% per

sources in Delaware, you must file a Delaware Tax return.

month, or fraction of a month, on any unpaid tax from the

original due date of the return until paid.

What Form to File

If an extension is not filed and if there is a balance due when

File Form:

the return is filed, a penalty will be charged for filing the

200-01 R

200-03 EZ

200-02 NR

return late. If you have doubt as to whether the final return

Full-year residents

will show a balance due, file Form 1027 for an extension.

or…

Part-year residents

To extend your due date for submitting your completed income

or…

or…

tax return (from April 30, 2004 to August 16, 2004), submit the

Non-residents

following to the Division of Revenue no later than April 30, 2004.

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4