Form Nc-Rehab Instructions - Historic Rehabilitation Tax Credits - 2016

ADVERTISEMENT

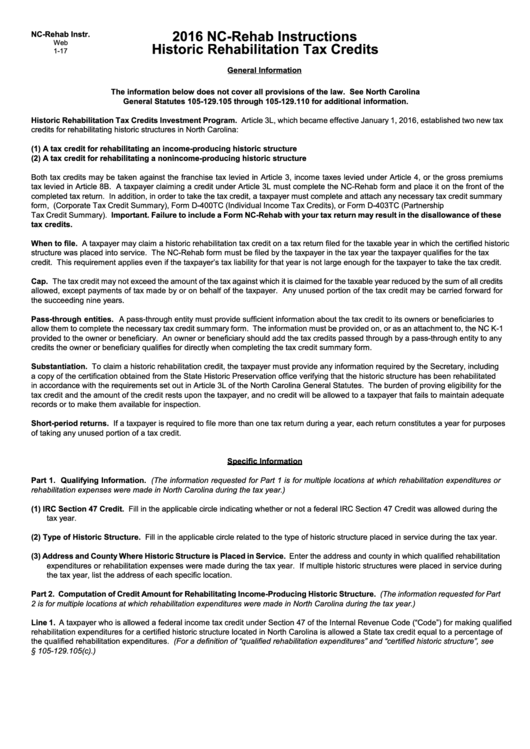

2016 NC-Rehab Instructions

NC-Rehab Instr.

Web

Historic Rehabilitation Tax Credits

1-17

General Information

The information below does not cover all provisions of the law. See North Carolina

General Statutes 105-129.105 through 105-129.110 for additional information.

Historic Rehabilitation Tax Credits Investment Program. Article 3L, which became effective January 1, 2016, established two new tax

credits for rehabilitating historic structures in North Carolina:

(1) A tax credit for rehabilitating an income-producing historic structure

(2) A tax credit for rehabilitating a nonincome-producing historic structure

Both tax credits may be taken against the franchise tax levied in Article 3, income taxes levied under Article 4, or the gross premiums

tax levied in Article 8B. A taxpayer claiming a credit under Article 3L must complete the NC-Rehab form and place it on the front of the

completed tax return. In addition, in order to take the tax credit, a taxpayer must complete and attach any necessary tax credit summary

form, i.e. Form CD-425 (Corporate Tax Credit Summary), Form D-400TC (Individual Income Tax Credits), or Form D-403TC (Partnership

Tax Credit Summary). Important. Failure to include a Form NC-Rehab with your tax return may result in the disallowance of these

tax credits.

When to file. A taxpayer may claim a historic rehabilitation tax credit on a tax return filed for the taxable year in which the certified historic

structure was placed into service. The NC-Rehab form must be filed by the taxpayer in the tax year the taxpayer qualifies for the tax

credit. This requirement applies even if the taxpayer’s tax liability for that year is not large enough for the taxpayer to take the tax credit.

Cap. The tax credit may not exceed the amount of the tax against which it is claimed for the taxable year reduced by the sum of all credits

allowed, except payments of tax made by or on behalf of the taxpayer. Any unused portion of the tax credit may be carried forward for

the succeeding nine years.

Pass-through entities. A pass-through entity must provide sufficient information about the tax credit to its owners or beneficiaries to

allow them to complete the necessary tax credit summary form. The information must be provided on, or as an attachment to, the NC K-1

provided to the owner or beneficiary. An owner or beneficiary should add the tax credits passed through by a pass-through entity to any

credits the owner or beneficiary qualifies for directly when completing the tax credit summary form.

Substantiation. To claim a historic rehabilitation credit, the taxpayer must provide any information required by the Secretary, including

a copy of the certification obtained from the State Historic Preservation office verifying that the historic structure has been rehabilitated

in accordance with the requirements set out in Article 3L of the North Carolina General Statutes. The burden of proving eligibility for the

tax credit and the amount of the credit rests upon the taxpayer, and no credit will be allowed to a taxpayer that fails to maintain adequate

records or to make them available for inspection.

Short-period returns. If a taxpayer is required to file more than one tax return during a year, each return constitutes a year for purposes

of taking any unused portion of a tax credit.

Specific Information

Part 1. Qualifying Information. (The information requested for Part 1 is for multiple locations at which rehabilitation expenditures or

rehabilitation expenses were made in North Carolina during the tax year.)

(1) IRC Section 47 Credit. Fill in the applicable circle indicating whether or not a federal IRC Section 47 Credit was allowed during the

tax year.

(2) Type of Historic Structure. Fill in the applicable circle related to the type of historic structure placed in service during the tax year.

(3) Address and County Where Historic Structure is Placed in Service. Enter the address and county in which qualified rehabilitation

expenditures or rehabilitation expenses were made during the tax year. If multiple historic structures were placed in service during

the tax year, list the address of each specific location.

Part 2. Computation of Credit Amount for Rehabilitating Income-Producing Historic Structure. (The information requested for Part

2 is for multiple locations at which rehabilitation expenditures were made in North Carolina during the tax year.)

Line 1. A taxpayer who is allowed a federal income tax credit under Section 47 of the Internal Revenue Code (“Code”) for making qualified

rehabilitation expenditures for a certified historic structure located in North Carolina is allowed a State tax credit equal to a percentage of

the qualified rehabilitation expenditures. (For a definition of “qualified rehabilitation expenditures” and “certified historic structure”, see

N.C. Gen. Stat. § 105-129.105(c).)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3