Form Nyc-9.5 - Claim For Sales Tax Or Reap Credit Applied To General Corporation Tax And Banking Corporation Tax - 2000

ADVERTISEMENT

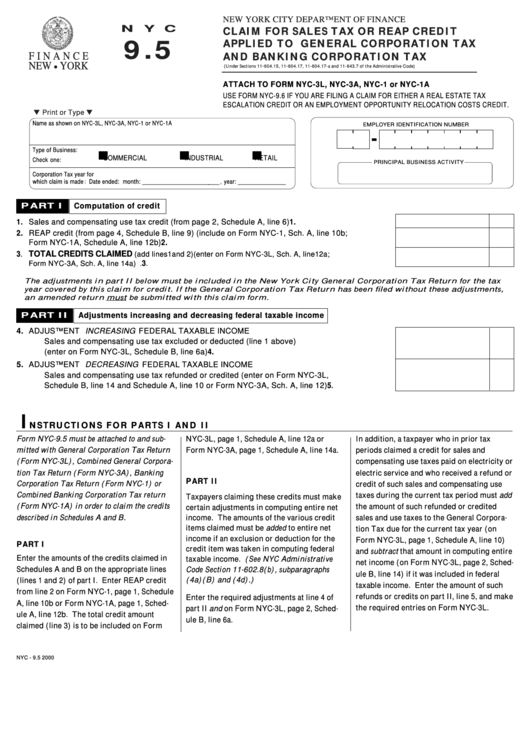

NEW YORK CITY DEPARTMENT OF FINANCE

N Y C

CLAIM FOR SALES TAX OR REAP CREDIT

9.5

APPLIED TO GENERAL CORPORATION TAX

F I N A N C E

AND BANKING CORPORATION TAX

NEW YORK

-

-

(Under Sections 11

604.15, 11

604.17, 11-604.17-a and 11-643.7 of the Administrative Code)

ATTACH TO FORM NYC-3L, NYC-3A, NYC-1 or NYC-1A

USE FORM NYC-9.6 IF YOU ARE FILING A CLAIM FOR EITHER A REAL ESTATE TAX

ESCALATION CREDIT OR AN EMPLOYMENT OPPORTUNITY RELOCATION COSTS CREDIT.

Print or Type

Name as shown on NYC-3L, NYC-3A, NYC-1 or NYC-1A

EMPLOYER IDENTIFICATION NUMBER

Type of Business:

COMMERCIAL

INDUSTRIAL

RETAIL

Check one:

PRINCIPAL BUSINESS ACTIVITY

Corporation Tax year for

which claim is made

Date ended: month: _________________________ , year: _______________

:

PART I

Computation of credit

1. Sales and compensating use tax credit (from page 2, Schedule A, line 6)

1.

..............................................

2. REAP credit (from page 4, Schedule B, line 9) (include on Form NYC-1, Sch. A, line 10b;

2.

Form NYC-1A, Schedule A, line 12b)

....................................................................................................................

3.

TOTAL CREDITS CLAIMED

(add lines 1 and 2) (enter on Form NYC-3L, Sch. A, line 12a;

3.

Form NYC-3A, Sch. A, line 14a)

................................................................................................................................

The adjustments in part II below must be included in the New York City General Corporation Tax Return for the tax

year covered by this claim for credit. If the General Corporation Tax Return has been filed without these adjustments,

an amended return must be submitted with this claim form.

PART II

Adjustments increasing and decreasing federal taxable income

4. ADJUSTMENT INCREASING FEDERAL TAXABLE INCOME

Sales and compensating use tax excluded or deducted (line 1 above)

4.

(enter on Form NYC-3L, Schedule B, line 6a)

.........................................................................................

5. ADJUSTMENT DECREASING FEDERAL TAXABLE INCOME

Sales and compensating use tax refunded or credited (enter on Form NYC-3L,

Schedule B, line 14 and Schedule A, line 10 or Form NYC-3A, Sch. A, line 12)

5

.........................

.

I

NSTRUCTIONS FOR PARTS I AND II

Form NYC-9.5 must be attached to and sub-

NYC-3L, page 1, Schedule A, line 12a or

In addition, a taxpayer who in prior tax

mitted with General Corporation Tax Return

Form NYC-3A, page 1, Schedule A, line 14a.

periods claimed a credit for sales and

(Form NYC-3L), Combined General Corpora-

compensating use taxes paid on electricity or

tion Tax Return (Form NYC-3A), Banking

electric service and who received a refund or

PART II

Corporation Tax Return (Form NYC-1) or

credit of such sales and compensating use

taxes during the current tax period must add

Combined Banking Corporation Tax return

Taxpayers claiming these credits must make

(Form NYC-1A) in order to claim the credits

the amount of such refunded or credited

certain adjustments in computing entire net

described in Schedules A and B.

income. The amounts of the various credit

sales and use taxes to the General Corpora-

items claimed must be added to entire net

tion Tax due for the current tax year (on

income if an exclusion or deduction for the

Form NYC-3L, page 1, Schedule A, line 10)

PART I

credit item was taken in computing federal

and subtract that amount in computing entire

Enter the amounts of the credits claimed in

taxable income. (See NYC Administrative

net income (on Form NYC-3L, page 2, Sched-

Schedules A and B on the appropriate lines

Code Section 11-602.8(b), subparagraphs

ule B, line 14) if it was included in federal

(4a)(B) and (4d).)

(lines 1 and 2) of part I. Enter REAP credit

taxable income. Enter the amount of such

from line 2 on Form NYC-1, page 1, Schedule

refunds or credits on part II, line 5, and make

Enter the required adjustments at line 4 of

A, line 10b or Form NYC-1A, page 1, Sched-

the required entries on Form NYC-3L.

part II and on Form NYC-3L, page 2, Sched-

ule A, line 12b. The total credit amount

ule B, line 6a.

claimed (line 3) is to be included on Form

NYC - 9.5 2000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3