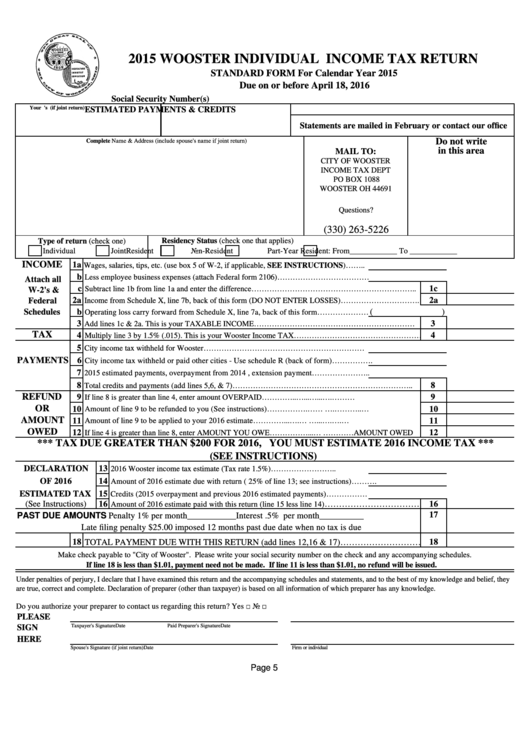

2015 WOOSTER INDIVIDUAL INCOME TAX RETURN

STANDARD FORM For Calendar Year 2015

Due on or before April 18, 2016

Social Security Number(s)

Your S.S. No.

Spouse's S.S. No. (if joint return)

ESTIMATED PAYMENTS & CREDITS

Statements are mailed in February or contact our office

Do not write

Complete Name & Address (include spouse's name if joint return)

in this area

MAIL TO:

CITY OF WOOSTER

INCOME TAX DEPT

PO BOX 1088

WOOSTER OH 44691

Questions?

(330) 263-5226

Residency Status (check one that applies)

Type of return (check one)

Individual

Joint

Resident

Non-Resident

Part-Year Resident: From____________ To ____________

INCOME

1a

Wages, salaries, tips, etc. (use box 5 of W-2, if applicable, SEE INSTRUCTIONS)……..

b

Less employee business expenses (attach Federal form 2106)………………………………

Attach all

c

1c

Subtract line 1b from line 1a and enter the difference………………………………………………………..

W-2's &

2a

2a

Federal

Income from Schedule X, line 7b, back of this form (DO NOT ENTER LOSSES)………………………….

Schedules

b

(

)

Operating loss carry forward from Schedule X, line 7a, back of this form………………….

3

3

Add lines 1c & 2a. This is your TAXABLE INCOME………………………………………………………

TAX

4

4

Multiply line 3 by 1.5% (.015). This is your Wooster Income TAX……………………………………………

5

City income tax withheld for Wooster………………………………………………………

PAYMENTS

6

City income tax withheld or paid other cities - Use schedule R (back of form)…………….

7

2015 estimated payments, overpayment from 2014 , extension payment…………………..

8

8

Total credits and payments (add lines 5,6, & 7)……………………………………………………………..

REFUND

9

9

If line 8 is greater than line 4, enter amount OVERPAID…………..…...…...….………..OVERPAYMENT

OR

10

10

Amount of line 9 to be refunded to you (See instructions)…………….……..........….………..…..REFUND

AMOUNT

11

11

Amount of line 9 to be applied to your 2016 estimate…………...….….....…...….….…...CREDIT TO 2016

OWED

12

12

If line 4 is greater than line 8, enter AMOUNT YOU OWE……………...…....…………AMOUNT OWED

*** TAX DUE GREATER THAN $200 FOR 2016, YOU MUST ESTIMATE 2016 INCOME TAX ***

(SEE INSTRUCTIONS)

DECLARATION

13

2016 Wooster income tax estimate (Tax rate 1.5%)……………………..

OF 2016

14

Amount of 2016 estimate due with return ( 25% of line 13; see instructions)……….

ESTIMATED TAX

15

Credits (2015 overpayment and previous 2016 estimated payments)………………

(See Instructions)

16

…………………………….

16

Amount of 2016 estimate paid with this return (line 15 less line 14)

17

PAST DUE AMOUNTS

Penalty 1% per month___________

Interest .5% per month__________

Late filing penalty $25.00 imposed 12 months past due date when no tax is due

18 TOTAL PAYMENT DUE WITH THIS RETURN (add lines 12,16 & 17)…………………………

18

Make check payable to "City of Wooster". Please write your social security number on the check and any accompanying schedules.

If line 18 is less than $1.01, payment need not be made. If line 11 is less than $1.01, no refund will be issued.

Under penalties of perjury, I declare that I have examined this return and the accompanying schedules and statements, and to the best of my knowledge and belief, they

are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Do you authorize your preparer to contact us regarding this return? Yes □ No □

PLEASE

Taxpayer's Signature

Date

Paid Preparer's Signature

Date

SIGN

HERE

Spouse's Signature (if joint return)

Date

Firm or individual

Page 5

1

1 2

2