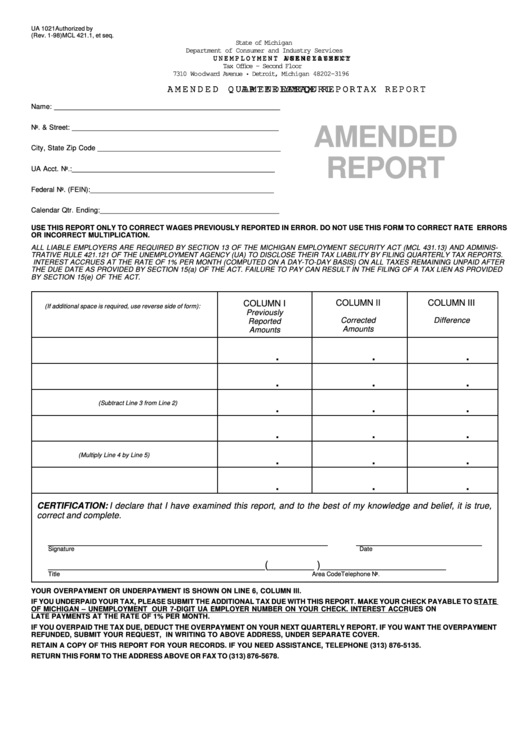

Form Ua 1021 - Amended Quarterly Tax Report - 1998

ADVERTISEMENT

UA 1021

Authorized by

(Rev. 1-98)

MCL 421.1, et seq.

State of Michigan

Department of Consumer and Industry Services

U N E M P L O Y M E N T

U N E M P L O Y M E N T

U N E M P L O Y M E N T

U N E M P L O Y M E N T

U N E M P L O Y M E N T A G E N C Y

A G E N C Y

A G E N C Y

A G E N C Y

A G E N C Y

Tax Office – Second Floor

7310 W oodward Avenue • Detroit, Michigan 48202-3196

A M E N D E D Q U

A M E N D E D Q U

A M E N D E D Q U

A M E N D E D Q U

A M E N D E D Q UA R T E R L

A R T E R L

A R T E R L

A R T E R L

A R T E R LY Y Y Y Y T T T T T A X R E P O R T

A X R E P O R T

A X R E P O R T

A X R E P O R T

A X R E P O R T

Name: __________________________________________________________

No. & Street: _____________________________________________________

AMENDED

City, State Zip Code _______________________________________________

REPORT

UA Acct. No.: ____________________________________________________

Federal No. (FEIN): _______________________________________________

Calendar Qtr. Ending: ______________________________________________

USE THIS REPORT ONLY TO CORRECT WAGES PREVIOUSLY REPORTED IN ERROR. DO NOT USE THIS FORM TO CORRECT RATE ERRORS

OR INCORRECT MULTIPLICATION.

ALL LIABLE EMPLOYERS ARE REQUIRED BY SECTION 13 OF THE MICHIGAN EMPLOYMENT SECURITY ACT (MCL 431.13) AND ADMINIS-

TRATIVE RULE 421.121 OF THE UNEMPLOYMENT AGENCY (UA) TO DISCLOSE THEIR TAX LIABILITY BY FILING QUARTERLY TAX REPORTS.

INTEREST ACCRUES AT THE RATE OF 1% PER MONTH (COMPUTED ON A DAY-TO-DAY BASIS) ON ALL TAXES REMAINING UNPAID AFTER

THE DUE DATE AS PROVIDED BY SECTION 15(a) OF THE ACT. FAILURE TO PAY CAN RESULT IN THE FILING OF A TAX LIEN AS PROVIDED

BY SECTION 15(e) OF THE ACT.

1. Reason for Adjustment

COLUMN II

COLUMN III

COLUMN I

(If additional space is required, use reverse side of form):

Previously

Corrected

Difference

Reported

Amounts

Amounts

2. Gross Quarterly Wages

.

.

.

3. Excess Wages

.

.

.

4. Taxable Wages

(Subtract Line 3 from Line 2)

.

.

.

5. Tax Rate

.

.

.

6. Total Tax

(Multiply Line 4 by Line 5)

.

.

.

7. Tax Paid

.

.

.

CERTIFICATION: I declare that I have examined this report, and to the best of my knowledge and belief, it is true,

correct and complete.

_________________________________________________

______________________

Signature

Date

______________________________________

( ________ ) ______________________

Title

Area Code

Telephone No.

YOUR OVERPAYMENT OR UNDERPAYMENT IS SHOWN ON LINE 6, COLUMN III .

IF YOU UNDERPAID YOUR TAX, PLEASE SUBMIT THE ADDITIONAL TAX DUE WITH THIS REPORT. MAKE YOUR CHECK PAYABLE TO STATE

OF MICHIGAN – UNEMPLOYMENT AGENCY. WRITE YOUR 7-DIGIT UA EMPLOYER NUMBER ON YOUR CHECK. INTEREST ACCRUES ON

LATE PAYMENTS AT THE RATE OF 1% PER MONTH.

IF YOU OVERPAID THE TAX DUE, DEDUCT THE OVERPAYMENT ON YOUR NEXT QUARTERLY REPORT. IF YOU WANT THE OVERPAYMENT

REFUNDED, SUBMIT YOUR REQUEST, IN WRITING TO ABOVE ADDRESS, UNDER SEPARATE COVER.

RETAIN A COPY OF THIS REPORT FOR YOUR RECORDS. IF YOU NEED ASSISTANCE, TELEPHONE (313) 876-5135.

RETURN THIS FORM TO THE ADDRESS ABOVE OR FAX TO (313) 876-5678.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1