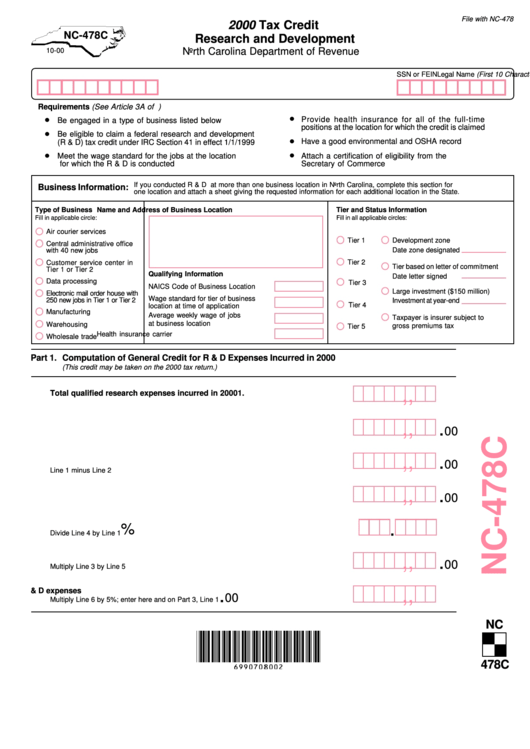

Form Nc-478c - Tax Credit Research And Development - 2000

ADVERTISEMENT

File with NC-478

2000 Tax Credit

NC-478C

Research and Development

North Carolina Department of Revenue

10-00

Legal Name (First 10 Characters)

SSN or FEIN

Requirements (See Article 3A of G.S. Chapter 105 and the Corporate Tax Bulletins for more information.)

Provide health insurance for all of the full-time

Be engaged in a type of business listed below

positions at the location for which the credit is claimed

Be eligible to claim a federal research and development

Have a good environmental and OSHA record

(R & D) tax credit under IRC Section 41 in effect 1/1/1999

Meet the wage standard for the jobs at the location

Attach a certification of eligibility from the N.C.

for which the R & D is conducted

Secretary of Commerce

If you conducted R & D at more than one business location in North Carolina, complete this section for

Business Information:

one location and attach a sheet giving the requested information for each additional location in the State.

Type of Business

Name and Address of Business Location

Tier and Status Information

Fill in applicable circle:

Fill in all applicable circles:

Air courier services

Tier 1

Development zone

Central administrative office

Date zone designated

with 40 new jobs

Tier 2

Customer service center in

Tier based on letter of commitment

Tier 1 or Tier 2

Qualifying Information

Date letter signed

Data processing

Tier 3

NAICS Code of Business Location

Large investment ($150 million)

Electronic mail order house with

Wage standard for tier of business

250 new jobs in Tier 1 or Tier 2

Investment at year-end

Tier 4

location at time of application

Manufacturing

Average weekly wage of jobs

Taxpayer is insurer subject to

at business location

Warehousing

gross premiums tax

Tier 5

Health insurance carrier

Wholesale trade

Part 1.

Computation of General Credit for R & D Expenses Incurred in 2000

(This credit may be taken on the 2000 tax return.)

,

,

.

1.

Total qualified research expenses incurred in 2000

00

,

,

.

2.

Base amount of qualified research expenses

00

,

,

.

3.

Excess qualified research expenses

00

Line 1 minus Line 2

,

,

.

4.

Qualified research expenses in N.C.

00

5.

Research expenses apportionment percentage

.

%

Divide Line 4 by Line 1

,

,

.

6.

Excess research activities apportioned to N.C.

00

Multiply Line 3 by Line 5

,

,

.

7.

General credit for 2000 R & D expenses

00

Multiply Line 6 by 5%; enter here and on Part 3, Line 1

NC

478C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2