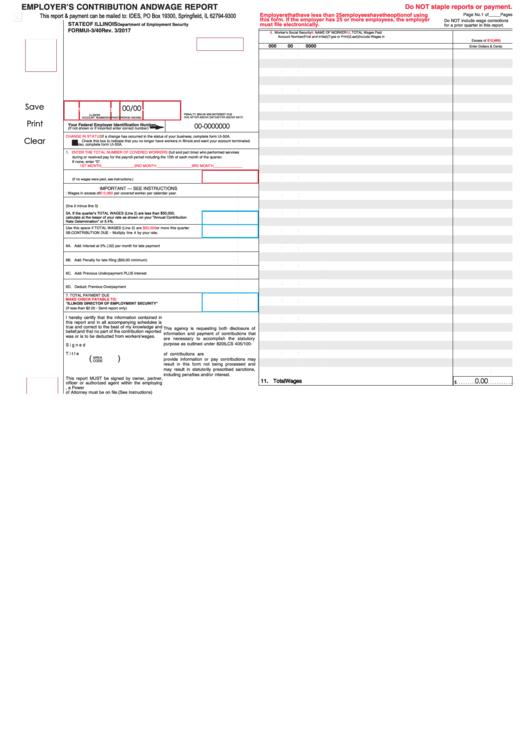

EMPLOYER’S CONTRIBUTION AND WAGE REPORT

Do NOT staple reports or payment.

This report & payment can be mailed to: IDES, PO Box 19300, Springfield, IL 62794-9300

Employers that have less than 25 employees have the option of using

Page No. 1 of_____Pages

this form. If the employer has 25 or more employees, the employer

Do NOT include wage corrections

must file electronically.

STATE OF ILLINOIS

Department of Employment Security

for a prior quarter in this report.

FORM UI-3/40 Rev. 3/2017

UCONTRIBUTION RATE FOR

D.C. NO.

8.

Worker’s Social Security

9.

NAME OF WORKER

10.

TOTAL Wages Paid

Account Number

(First and initial)

(Type or Print)

(Last)

(Include Wages in

Excess of $12,960)

L07ZZZZZZZ

:

:

000

00

0000

Enter Dollars & Cents:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

Save

00/00

:

:

R

9999999

9 20062 L10ZZ-2006

PENALTY ($50.00 MIN.)

INTEREST DUE

:

:

:

ILLINOIS

ACCOUNT NUMBER

CK

YR/QTR

PERIOD ENDING

DUE AFTER ABOVE DATE

AFTER ABOVE DATE

Print

00-0000000

:

:

Your Federal Employer Identification Number

L09ZZZZZZZ

(If not shown or if incorrect enter correct number)

:

:

:

Clear

CHANGE IN STATUS

If a change has occurred in the status of your business, complete form UI-50A.

I I

Check this box to indicate that you no longer have workers in Illinois and want your account terminated.

:

:

Also, complete form UI-50A.

:

:

:

1.

ENTER THE TOTAL NUMBER OF COVERED WORKERS

(full and part time) who performed services

during or received pay for the payroll period including the 12th of each month of the quarter.

:

:

If none, enter “0”.

1ST MONTH________________2ND MONTH_________________3RD MONTH______________

:

:

:

. .

2. TOTAL WAGES PAID for covered employment

.

:

:

(If no wages were paid, see instructions.)

. .

:

:

:

IMPORTANT — SEE INSTRUCTIONS

. .

3. LESS: Wages in excess of

$12,960

per covered worker per calendar year.

:

:

. .

. .

:

:

:

4. TAXABLE WAGES (line 2 minus line 3)

. .

:

:

5A. If the quarter’s TOTAL WAGES (Line 2) are less than $50,000,

. .

calculate at the lessor of your rate as shown on your "Annual Contribution

Rate Determination" or 5.4%.

:

:

:

. .

or more this quarter.

Use this space if TOTAL WAGES (Line 2) are

$50,000

. .

:

:

5B. CONTRIBUTION DUE - Multiply line 4 by your rate.

. .

:

:

:

. .

6A. Add: Interest at 2% (.02) per month for late payment

:

:

. .

:

:

:

. .

6B. Add: Penalty for late filing ($50.00 minimum)

. .

:

:

. .

6C. Add: Previous Underpayment PLUS interest

:

:

:

. .

:

:

. .

6D. Deduct: Previous Overpayment

:

:

:

. .

7. TOTAL PAYMENT DUE

MAKE CHECK PAYABLE TO:

. .

:

:

“ILLINOIS DIRECTOR OF EMPLOYMENT SECURITY”

.

(If less than $2.00 - Send report only)

:

:

:

:

:

I hereby certify that the information contained in

this report and in all accompanying schedules is

:

:

:

true and correct to the best of my knowledge and

This agency is requesting both disclosure of

belief; and that no part of the contribution reported

information and payment of contributions that

:

:

was or is to be deducted from workers’ wages.

are necessary to accomplish the statutory

purpose as outlined under 820 ILCS 405/100-

:

:

:

Signed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3200. Disclosure of information and payment

:

:

Title . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

of contributions are REQUIRED.

Failure to

(

)

AREA

provide information or pay contributions may

:

:

:

CODE

Telephone. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

result in this form not being processed and

may result in statutorily prescribed sanctions,

:

Date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

including penalties and/or interest.

0.00

This report MUST be signed by owner, partner,

:

11. Total Wages

$. . . . . . . . . . . . . . . . . . . . . . . . . .

officer or authorized agent within the employing

enterprise. If signed by any other person, a Power

of Attorney must be on file.

(See Instructions)

1

1 2

2