Please note: This form will not work in the Chrome Browser

Reset Form

Print Form

Print Form

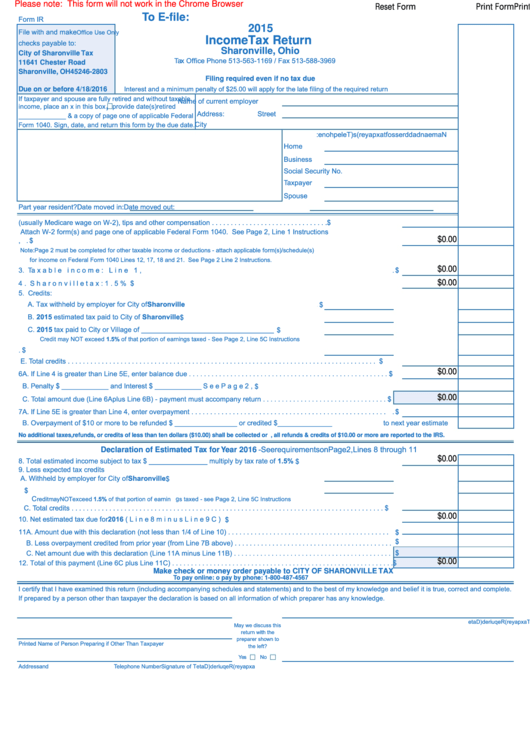

To E-file:

Form IR

2015

File with and make

Office Use Only

Income Tax Return

checks payable to:

Sharonville, Ohio

City of Sharonville Tax

Tax Office Phone 513-563-1169 / Fax 513-588-3969

11641 Chester Road

Sharonville, OH 45246-2803

Filing required even if no tax due

Due on or before 4/18/2016

Interest and a minimum penalty of $25.00 will apply for the late filing of the required return

If taxpayer and spouse are fully retired and without taxable

Name of current employer

,

income, place an x in this box

provide date(s) retired

Address:

Street

_____________ & a copy of page one of applicable Federal

City

Form 1040. Sign, date, and return this form by the due date.

N

a

m

e

a

n

d

a

d

d

e r

s s

f o

a t

x

p

a

y

e

( r

) s

T

e

e l

p

h

o

n

: e

Home

Business

Social Security No.

Taxpayer

Spouse

Part year resident? Date moved in:

Date moved out:

1. Qualifying wages (usually Medicare wage on W-2), tips and other compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

Attach W-2 form(s) and page one of applicable Federal Form 1040. See Page 2, Line 1 Instructions

$0.00

2. Other taxable income or deductions from Page 2, Line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

Note: Page 2 must be completed for other taxable income or deductions - attach applicable form(s)/schedule(s)

for income on Federal Form 1040 Lines 12, 17, 18 and 21. See Page 2 Line 2 Instructions.

$0.00

3. Taxable income: Line 1, plus or minus Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

$0.00

4. Sharonville tax: 1.5% of Line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

5. Credits:

A. Tax withheld by employer for City of Sharonville. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. $

B. 2015 estimated tax paid to City of Sharonville. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

C. 2015 tax paid to City or Village of __________________________________ . . . . . . . . . . . $

Credit may NOT exceed 1.5% of that portion of earnings taxed - See Page 2, Line 5C Instructions

D. Prior year overpayments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

E. Total credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

$0.00

6A. If Line 4 is greater than Line 5E, enter balance due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

B. Penalty $ ____________ and Interest $ ____________ See Page 2, Line 6B Instructions . . . . . . . . . . . . . . . . . . . . . . . $

$0.00

C. Total amount due (Line 6A plus Line 6B) - payment must accompany return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

7A. If Line 5E is greater than Line 4, enter overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

B. Overpayment of $10 or more to be refunded $ ________________ or credited $ _____________

_

to next year estimate

No additional taxes, refunds, or credits of less than ten dollars ($10.00) shall be collected or refunded.

By law, all refunds & credits of $10.00 or more are reported to the IRS.

Declaration of Estimated Tax for Year 2016 - See requirements on Page 2, Lines 8 through 11

$0.00

8. Total estimated income subject to tax $ _______________ multiply by tax rate of 1.5% for gross tax of . . . . . . . . . . . . . . $

9. Less expected tax credits

A. Withheld by employer for City of Sharonville. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

B. Payments to another municipality . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

C

redit may NOT exceed 1.5% of that portion of earnings taxed - see Page 2, Line 5C Instructions

C. Total credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

$0.00

10. Net estimated tax due for 2016 (Line 8 minus Line 9C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

11A. Amount due with this declaration (not less than 1/4 of Line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

B. Less overpayment credited from prior year (from Line 7B above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C. Net amount due with this declaration (Line 11A minus Line 11B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

$0.00

12. Total of this payment (Line 6C plus Line 11C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

Make check or money order payable to

CITY OF SHARONVILLE TAX

To pay online: / To pay by phone: 1-800-487-4567

I certify that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct and complete.

If prepared by a person other than taxpayer the declaration is based on all information of which preparer has any knowledge.

S

g i

n

a

u t

e r

f o

P

e

s r

o

n

P

e r

p

r a

n i

g

f i

O

h t

r e

T

h

a

n

T

a

x

p

a

y

r e

D

a

e t

S

g i

n

a

u t

e r

f o

T

a

x

p

a

y

e

( r

R

e

q

i u

e r

) d

D

a

e t

May we discuss this

return with the

preparer shown to

Printed Name of Person Preparing if Other Than Taxpayer

the left?

Yes

No

Address

and

Telephone Number

Signature of T

a

x

p

a

y

e

( r

R

e

q

i u

e r

) d

D

a

e t

1

1 2

2