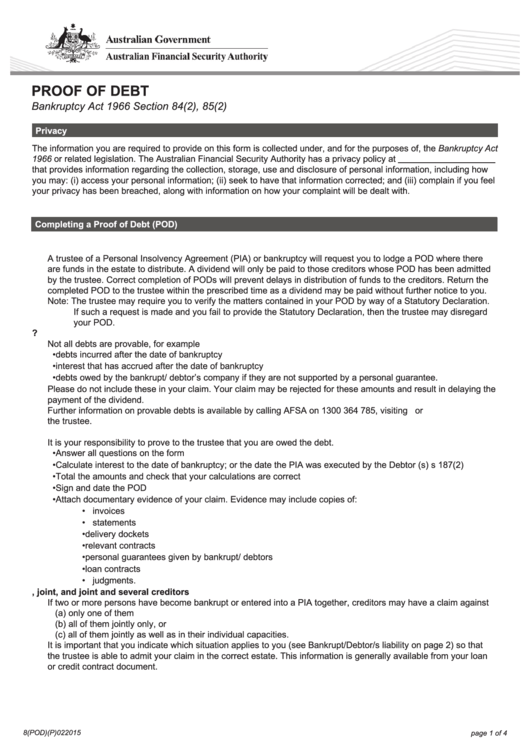

PROOF OF DEBT

Bankruptcy Act 1966 Section 84(2), 85(2)

Privacy

The information you are required to provide on this form is collected under, and for the purposes of, the Bankruptcy Act

1966 or related legislation. The Australian Financial Security Authority has a privacy policy at

that provides information regarding the collection, storage, use and disclosure of personal information, including how

you may: (i) access your personal information; (ii) seek to have that information corrected; and (iii) complain if you feel

your privacy has been breached, along with information on how your complaint will be dealt with.

Completing a Proof of Debt (POD)

1. When to lodge a Proof of Debt

A trustee of a Personal Insolvency Agreement (PIA) or bankruptcy will request you to lodge a POD where there

are funds in the estate to distribute. A dividend will only be paid to those creditors whose POD has been admitted

by the trustee. Correct completion of PODs will prevent delays in distribution of funds to the creditors. Return the

completed POD to the trustee within the prescribed time as a dividend may be paid without further notice to you.

Note: The trustee may require you to verify the matters contained in your POD by way of a Statutory Declaration.

If such a request is made and you fail to provide the Statutory Declaration, then the trustee may disregard

your POD.

2. Which debts are provable?

Not all debts are provable, for example

• debts incurred after the date of bankruptcy

• interest that has accrued after the date of bankruptcy

• debts owed by the bankrupt/ debtor’s company if they are not supported by a personal guarantee.

Please do not include these in your claim. Your claim may be rejected for these amounts and result in delaying the

payment of the dividend.

Further information on provable debts is available by calling AFSA on 1300 364 785, visiting or

the trustee.

3. Instructions on completion of the POD

It is your responsibility to prove to the trustee that you are owed the debt.

• Answer all questions on the form

• Calculate interest to the date of bankruptcy; or the date the PIA was executed by the Debtor (s) s 187(2)

• Total the amounts and check that your calculations are correct

• Sign and date the POD

• Attach documentary evidence of your claim. Evidence may include copies of:

• invoices

• statements

• delivery dockets

• relevant contracts

• personal guarantees given by bankrupt/ debtors

• loan contracts

• judgments.

4. Separate, joint, and joint and several creditors

If two or more persons have become bankrupt or entered into a PIA together, creditors may have a claim against

(a) only one of them

(b) all of them jointly only, or

(c) all of them jointly as well as in their individual capacities.

It is important that you indicate which situation applies to you (see Bankrupt/Debtor/s liability on page 2) so that

the trustee is able to admit your claim in the correct estate. This information is generally available from your loan

or credit contract document.

8(POD)(P)022015

- 1300 364 785

page 1 of 4

1

1 2

2 3

3 4

4