Ira Beneficiary Claim Form

Download a blank fillable Ira Beneficiary Claim Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Ira Beneficiary Claim Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

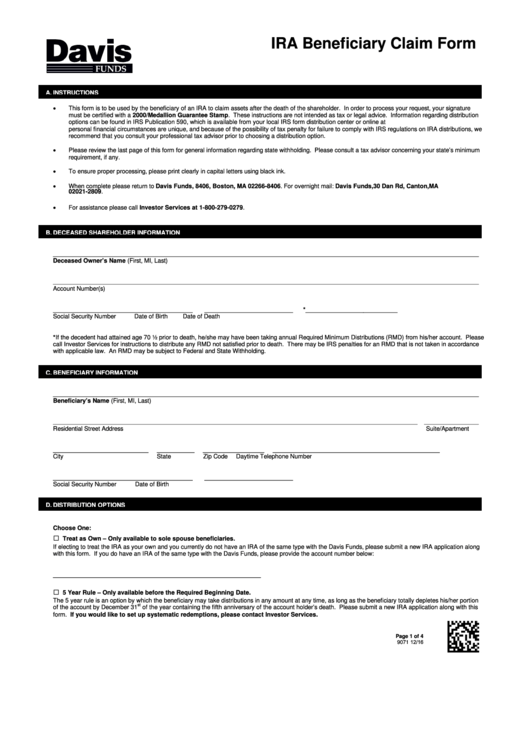

IRA Beneficiary Claim Form

A. INSTRUCTIONS

This form is to be used by the beneficiary of an IRA to claim assets after the death of the shareholder. In order to process your request, your signature

must be certified with a 2000/Medallion Guarantee Stamp. These instructions are not intended as tax or legal advice. Information regarding distribution

options can be found in IRS Publication 590, which is available from your local IRS form distribution center or online at Because your

personal financial circumstances are unique, and because of the possibility of tax penalty for failure to comply with IRS regulations on IRA distributions, we

recommend that you consult your professional tax advisor prior to choosing a distribution option.

Please review the last page of this form for general information regarding state withholding. Please consult a tax advisor concerning your state’s minimum

requirement, if any.

To ensure proper processing, please print clearly in capital letters using black ink.

When complete please return to Davis Funds, P.O. Box 8406, Boston, MA 02266-8406. For overnight mail: Davis Funds, 30 Dan Rd, Canton, MA

02021-2809.

For assistance please call Investor Services at 1-800-279-0279.

B. DECEASED SHAREHOLDER INFORMATION

_____________________________________________________________________________________________________________________________

Deceased Owner’s Name (First, MI, Last)

_____________________________________________________________________________________________________________________________

Account Number(s)

_________________________________________

__________________________

*___________________________

Social Security Number

Date of Birth

Date of Death

*If the decedent had attained age 70 ½ prior to death, he/she may have been taking annual Required Minimum Distributions (RMD) from his/her account. Please

call Investor Services for instructions to distribute any RMD not satisfied prior to death. There may be IRS penalties for an RMD that is not taken in accordance

with applicable law. An RMD may be subject to Federal and State Withholding.

C. BENEFICIARY INFORMATION

_____________________________________________________________________________________________________________________________

Beneficiary’s Name (First, MI, Last)

___________________________________________________________________________________________________________

________________

Residential Street Address

Suite/Apartment

____________________________

___________

__________________

_________________________________________________

City

State

Zip Code

Daytime Telephone Number

_________________________________________

__________________________

Social Security Number

Date of Birth

D. DISTRIBUTION OPTIONS

Choose One:

□

Treat as Own – Only available to sole spouse beneficiaries.

If electing to treat the IRA as your own and you currently do not have an IRA of the same type with the Davis Funds, please submit a new IRA application along

with this form. If you do have an IRA of the same type with the Davis Funds, please provide the account number below:

_____________________________________________________________

□

5 Year Rule – Only available before the Required Beginning Date.

The 5 year rule is an option by which the beneficiary may take distributions in any amount at any time, as long as the beneficiary totally depletes his/her portion

st

of the account by December 31

of the year containing the fifth anniversary of the account holder’s death. Please submit a new IRA application along with this

form. If you would like to set up systematic redemptions, please contact Investor Services.

Page 1 of 4

9071 12/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4