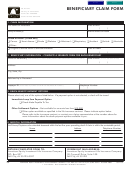

Ira Beneficiary Claim Form Page 2

Download a blank fillable Ira Beneficiary Claim Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Ira Beneficiary Claim Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

DISTRIBUTION OPTIONS (continued)

□

Single Life Expectancy – These are distributions based on the single life expectancy of either the beneficiary or the (deceased) account holder. The

amount may be recalculated or non-recalculated depending on circumstances such as beneficiary relationship and the age of the deceased account holder.

Please submit a new IRA application along with this form. If you would like to set up systematic distributions, please complete numbers 1 and 2 below and

section F.

1. Start date*: __________ /____________ / ____________. (Generally, distributions must start by December 31st of the year following the death of the

account holder however, if you are a spouse beneficiary, there may be alternate start dates you may choose from. All beneficiary types should review IRS

rules regarding Inherited IRAs.)

* We will use the day of the month you have indicated in your start date for future distributions unless you select another date by calling investor services.

2. Frequency of withdrawals:

□

□

□

□

□

□

□

□

□

□

□

□

□

All Months

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sept Oct

Nov

Dec

or

□

Lump Sum – Full liquidation. Please also complete section F.

E. W-4P TAX WITHHOLDING ELECTION

Federal Taxes:

State Taxes:

See “State Tax Withholding” on the

(If no election is made, 10% will be withheld.)

last page of this form for more information.

□

□

Do NOT withhold federal taxes.

Do NOT withhold state taxes unless required by law.

□

□

*Withhold federal taxes at a rate of:

Withhold state taxes at the applicable rate.

□

*Minimum 10%, maximum 100%. Whole numbers, no dollar

Maryland Only:

amounts. Note that if there is federal withholding, certain

Voluntary election – Withhold at a rate of:

states require that there also be state withholding.

Percentage

Percentage

%

%

*For systematic distributions, the federal tax withholding election indicated above will remain effective until you change it. You may change or revoke your federal tax withholding

election at any time.

F. DELIVERY INSTRUCTIONS

Choose One:

□

Standard mail to the address of record.

□

Overnight mail to the address of record. There is a $25 fee for domestic service.

□

Mail check to an alternate address or a third party.

□

Delivery method:

Standard mail

□

Overnight mail. There is a $25 fee for domestic service.

________________________________________________________

Name of Payee

_________________________________________________________

Address

_________________________________________________________

City

State

Zip Code

□

ACH transfer to bank account. Please indicate your bank account in section G.

□

Wire transfer to bank account. There is a $5 fee for this service. Wire is not available on systematic distributions. Please indicate your bank

account in section G.

Page 2 of 4

9071 12/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4