Ira Beneficiary Claim Form Page 4

Download a blank fillable Ira Beneficiary Claim Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Ira Beneficiary Claim Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

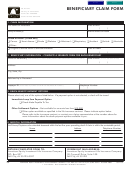

I. SIGNATURE

The undersigned individual authorizes the withdrawal specified above and the withholding election completed above. It is the undersigned's responsibility to determine correctly the amount

of tax that may be due based on all IRA accounts the undersigned may own (including those unknown by or not under the control of the Custodian). The undersigned agrees to indemnify

and hold harmless the Custodian and its agents and service providers, including Davis Funds from any losses or expenses incurred if such information is not correct. The undersigned

acknowledges that it is his/her responsibility to properly calculate, report, and pay all taxes due with respect to the withdrawal specified above.

Substitute Form W-9

I certify under penalty of perjury that:

1. The number shown on this application is my correct Taxpayer Identification number, and

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject

to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

3. I am a U.S. person or a U.S. Resident Alien.

You must cross out item number 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all

interest and dividends on your tax return.

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications above to avoid backup withholding.

_____________________________________________________________

Signature

_____________________________________________________________

____________________________

Capacity (e.g. Beneficiary, Executor)

Date

Place 2000/MedallionGuarantee Stamp Here

STATE TAX WITHHOLDING

If your state requires withholding, Davis Funds will withhold at least the required minimum state tax, regardless of your

election. Davis Funds does not withhold state taxes for all states.

State of

State tax withholding options

residence

AR, CA, DE, IA, KS, MD,

State withholding is voluntary whether or not you choose to withhold federal taxes.

NC, OK

State withholding is voluntary on Normal Distributions.

MS

State withholding is mandatory on Premature Distributions and Excess Contribution Returns.

If you choose federal withholding, you will also be subject to your state’s minimum

withholding rate unless you request otherwise.

ME, MA, NE, OR, VT, VA

If you do NOT choose federal withholding, state withholding is voluntary.

State withholding is voluntary on partial distributions.

DC

State withholding is mandatory on full liquidations.

MI requires state income tax of at least your state’s minimum requirements regardless of

whether or not federal income tax is withheld.

Tax withholding is not required if you meet certain MI requirements governing pension and

MI

retirement benefits. Please reference the MI W-4P form for additional information about

calculating the amount to withhold from your distribution.

Contact your tax advisor or investment representative for additional information about MI

requirements.

This tax information is for informational purposes only and should

We do not provide tax or legal advice and will not be liable for any

not be considered legal or tax advice. Always consult a tax or

decision you make based on this or other general tax information we

legal professional before making financial decisions.

provide.

Page 4 of 4

9071 12/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4