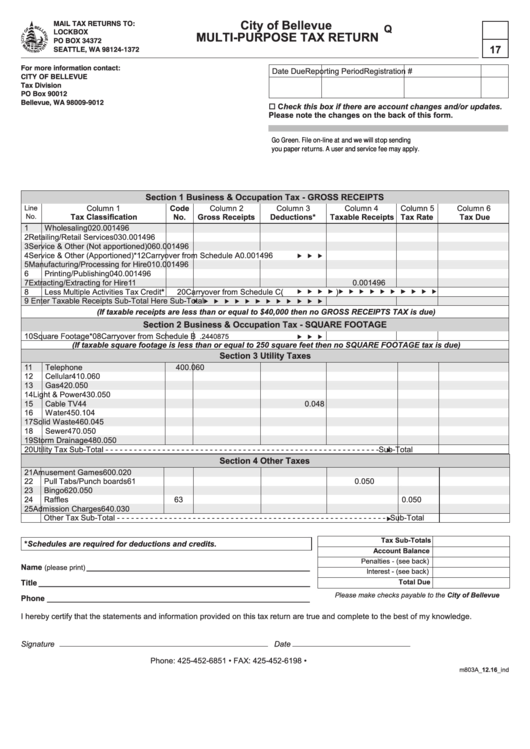

City of Bellevue

MAIL TAX RETURNS TO:

Q

LOCKBOX

MULTI-PURPOSE TAX RETURN

PO BOX 34372

17

SEATTLE, WA 98124-1372

For more information contact:

Check

Date Due

Reporting Period

Registration #

CITY OF BELLEVUE

Digit

Tax Division

PO Box 90012

Bellevue, WA 98009-9012

o Check this box if there are account changes and/or updates.

Please note the changes on the back of this form.

Go Green. File on-line at

https://

and we will stop sending

you paper returns. A user and service fee may apply.

Section 1 Business & Occupation Tax - GROSS RECEIPTS

Line

Column 1

Code

Column 2

Column 3

Column 4

Column 5

Column 6

Tax Classification

No.

Gross Receipts

Deductions*

Taxable Receipts

Tax Rate

Tax Due

No.

1

Wholesaling

02

0.001496

2

Retailing/Retail Services

03

0.001496

3

Service & Other (Not apportioned)

06

0.001496

4

Service & Other (Apportioned) *

12

Carryover from Schedule A

0.001496

5

Manufacturing/Processing for Hire

01

0.001496

6

Printing/Publishing

04

0.001496

7

Extracting/Extracting for Hire

11

0.001496

8

Less Multiple Activities Tax Credit*

20

Carryover from Schedule C

(

)

9

Enter Taxable Receipts Sub-Total Here

Sub-Total

(If taxable receipts are less than or equal to $40,000 then no GROSS RECEIPTS TAX is due)

Section 2 Business & Occupation Tax - SQUARE FOOTAGE

10

Square Footage*

08

Carryover from Schedule B

0.2440875

(If taxable square footage is less than or equal to 250 square feet then no SQUARE FOOTAGE tax is due)

Section 3 Utility Taxes

11

Telephone

40

0.060

12

Cellular

41

0.060

13

Gas

42

0.050

14

Light & Power

43

0.050

15

Cable TV

44

0.048

16

Water

45

0.104

17

Solid Waste

46

0.045

18

Sewer

47

0.050

19

Storm Drainage

48

0.050

20

Utility Tax Sub-Total - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Sub-Total

Section 4 Other Taxes

21

Amusement Games

60

0.020

22

Pull Tabs/Punch boards

61

0.050

23

Bingo

62

0.050

24

Raffles

63

0.050

25

Admission Charges

64

0.030

Other Tax Sub-Total - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Sub-Total

Tax Sub-Totals

*Schedules are required for deductions and credits.

Account Balance

Penalties - (see back)

Name

___________________________________________________

(please print)

Interest - (see back)

Total Due

Title ______________________________________________________________

Please make checks payable to the City of Bellevue

Phone ____________________________________________________________

I hereby certify that the statements and information provided on this tax return are true and complete to the best of my knowledge.

Signature

Date

Phone: 425-452-6851 • FAX: 425-452-6198 • tax@bellevuewa.gov

m803A_12.16_ind

1

1 2

2 3

3 4

4