Form St-40 - Sales And Use Tax Lessor Certification - 1999

ADVERTISEMENT

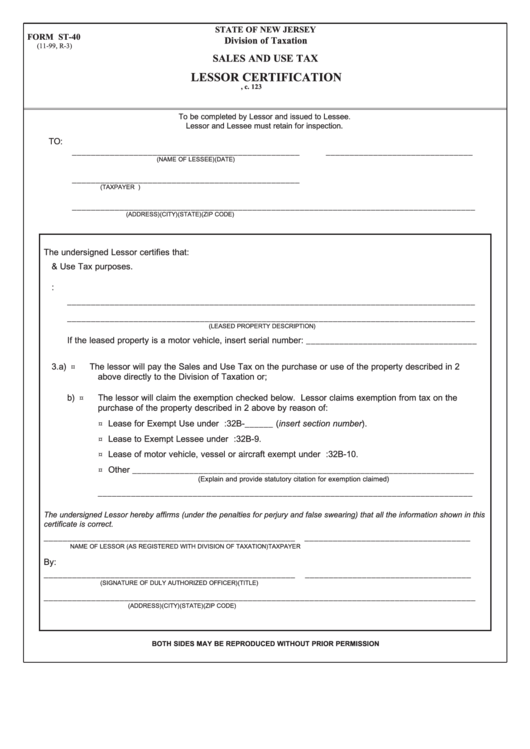

STATE OF NEW JERSEY

FORM ST-40

Division of Taxation

(11-99, R-3)

SALES AND USE TAX

LESSOR CERTIFICATION

P.L. 1989, c. 123

To be completed by Lessor and issued to Lessee.

Lessor and Lessee must retain for inspection.

TO:

________________________________________________

_______________________________

(NAME OF LESSEE)

(DATE)

________________________________________________

(TAXPAYER I.D. NUMBER OR SOCIAL SECURITY NUMBER)

_____________________________________________________________________________________

(ADDRESS)

(CITY)

(STATE)

(ZIP CODE)

The undersigned Lessor certifies that:

1. The Lessor is registered with the New Jersey Division of Taxation for Sales & Use Tax purposes.

2. The property subject to this lease transaction is:

______________________________________________________________________________________

______________________________________________________________________________________

(LEASED PROPERTY DESCRIPTION)

If the leased property is a motor vehicle, insert serial number: ____________________________________

3. a) ¤

The lessor will pay the Sales and Use Tax on the purchase or use of the property described in 2

above directly to the Division of Taxation or;

b) ¤

The lessor will claim the exemption checked below. Lessor claims exemption from tax on the

purchase of the property described in 2 above by reason of:

¤ Lease for Exempt Use under N.J.S.A. 54:32B-______ (insert section number).

¤ Lease to Exempt Lessee under N.J.S.A. 54:32B-9.

¤ Lease of motor vehicle, vessel or aircraft exempt under N.J.S.A. 54:32B-10.

¤ Other ________________________________________________________________________

(Explain and provide statutory citation for exemption claimed)

_______________________________________________________________________________

The undersigned Lessor hereby affirms (under the penalties for perjury and false swearing) that all the information shown in this

certificate is correct.

_____________________________________________________

___________________________________

NAME OF LESSOR (AS REGISTERED WITH DIVISION OF TAXATION)

TAXPAYER I.D. NUMBER

By:

_____________________________________________________

___________________________________

(SIGNATURE OF DULY AUTHORIZED OFFICER)

(TITLE)

___________________________________________________________________________________________

(ADDRESS)

(CITY)

(STATE)

(ZIP CODE)

BOTH SIDES MAY BE REPRODUCED WITHOUT PRIOR PERMISSION

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1