Form Mi-1040x - Amended Michigan Income Tax Return - 2000

ADVERTISEMENT

(Rev. 10-00)

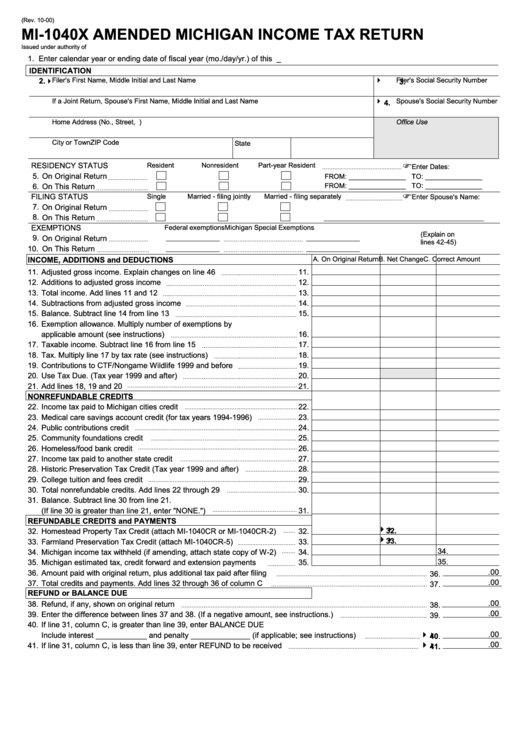

MI-1040X AMENDED MICHIGAN INCOME TAX RETURN

Issued under authority of P.A. 281 of 1967.

1. Enter calendar year or ending date of fiscal year (mo./day/yr.) of this return......................... ___________________

IDENTIFICATION

2.

Filer's First Name, Middle Initial and Last Name

Filer's Social Security Number

3.

If a Joint Return, Spouse's First Name, Middle Initial and Last Name

Spouse's Social Security Number

4.

Home Address (No., Street, P.O. Box or Rural Route)

Office Use

City or Town

ZIP Code

State

RESIDENCY STATUS

Resident

Nonresident

Part-year Resident

Enter Dates:

5.

On Original Return

FROM: _______________ TO: _______________

6.

On This Return

FROM: _______________ TO: _______________

FILING STATUS

Single

Married - filing jointly

Married - filing separately

Enter Spouse's Name:

7.

On Original Return

8.

On This Return

EXEMPTIONS

Federal exemptions

Michigan Special Exemptions

(Explain on

9.

On Original Return

lines 42-45)

10.

On This Return

INCOME, ADDITIONS and DEDUCTIONS

A. On Original Return B. Net Change

C. Correct Amount

11.

Adjusted gross income. Explain changes on line 46

11.

12.

Additions to adjusted gross income

12.

13.

Total income. Add lines 11 and 12

13.

14.

Subtractions from adjusted gross income

14.

15.

Balance. Subtract line 14 from line 13

15.

16.

Exemption allowance. Multiply number of exemptions by

applicable amount (see instructions)

16.

17.

Taxable income. Subtract line 16 from line 15

17.

18.

Tax. Multiply line 17 by tax rate (see instructions)

18.

19.

Contributions to CTF/Nongame Wildlife 1999 and before

19.

20.

Use Tax Due. (Tax year 1999 and after)

20.

21.

Add lines 18, 19 and 20

21.

NONREFUNDABLE CREDITS

22.

Income tax paid to Michigan cities credit

22.

23.

Medical care savings account credit (for tax years 1994-1996)

23.

24.

Public contributions credit

24.

25.

Community foundations credit

25.

26.

Homeless/food bank credit

26.

27.

Income tax paid to another state credit

27.

28.

Historic Preservation Tax Credit (Tax year 1999 and after)

28.

29.

College tuition and fees credit

29.

30.

Total nonrefundable credits. Add lines 22 through 29

30.

31.

Balance. Subtract line 30 from line 21.

(If line 30 is greater than line 21, enter "NONE.")

31.

REFUNDABLE CREDITS and PAYMENTS

32.

32.

Homestead Property Tax Credit (attach MI-1040CR or MI-1040CR-2)

32.

33.

33.

Farmland Preservation Tax Credit (attach MI-1040CR-5)

33.

34.

34.

Michigan income tax withheld (if amending, attach state copy of W-2)

34.

35.

35.

Michigan estimated tax, credit forward and extension payments

35.

.00

36.

Amount paid with original return, plus additional tax paid after filing

36.

.00

37.

Total credits and payments. Add lines 32 through 36 of column C

37.

REFUND or BALANCE DUE

.00

38.

Refund, if any, shown on original return

38.

.00

39.

Enter the difference between lines 37 and 38. (If a negative amount, see instructions.)

39.

40.

If line 31, column C, is greater than line 39, enter BALANCE DUE

.00

Include interest ____________ and penalty ______________ (if applicable; see instructions)

40.

.00

41.

If line 31, column C, is less than line 39, enter REFUND to be received

41.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2