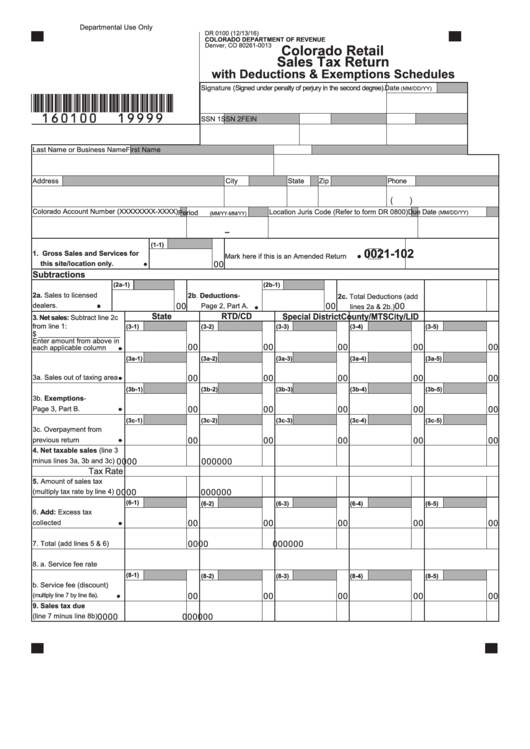

Departmental Use Only

DR 0100 (12/13/16)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0013

Colorado Retail

Sales Tax Return

with Deductions & Exemptions Schedules

Signature (Signed under penalty of perjury in the second degree). Date

(MM/DD/YY)

*160100==19999*

SSN 1

SSN 2

FEIN

Last Name or Business Name

First Name

Address

City

State

Zip

Phone

(

)

Colorado Account Number (XXXXXXXX-XXXX)

Location Juris Code (Refer to form DR 0800)

Due Date

Period

(MM/DD/YY)

(MM/YY-MM/YY)

–

(1-1)

0021-102

1. Gross Sales and Services for

Mark here if this is an Amended Return

00

this site/location only.

Subtractions

(2a-1)

(2b-1)

2a. Sales to licensed

2b. Deductions-

2c. Total Deductions (add

00

00

00

dealers.

Page 2, Part A.

lines 2a & 2b.)

State

RTD/CD

Special District

County/MTS

City/LID

3. Net sales: Subtract line 2c

from line 1:

(3-1)

(3-2)

(3-3)

(3-4)

(3-5)

$ _____________________

Enter amount from above in

00

00

00

00

00

each applicable column

(3a-1)

(3a-2)

(3a-3)

(3a-4)

(3a-5)

00

00

00

00

00

3a. Sales out of taxing area

(3b-1)

(3b-2)

(3b-3)

(3b-4)

(3b-5)

3b. Exemptions-

00

00

00

00

00

Page 3, Part B.

(3c-1)

(3c-2)

(3c-3)

(3c-4)

(3c-5)

3c. Overpayment from

00

00

00

00

00

previous return

4. Net taxable sales (line 3

00

00

00

00

00

minus lines 3a, 3b and 3c)

Tax Rate

5. Amount of sales tax

00

00

00

00

00

(multiply tax rate by line 4)

(6-1)

(6-2)

(6-3)

(6-4)

(6-5)

6. Add: Excess tax

00

00

00

00

00

collected

00

00

00

00

00

7. Total (add lines 5 & 6)

8. a. Service fee rate

(8-1)

(8-2)

(8-3)

(8-4)

(8-5)

b. Service fee (discount)

00

00

00

00

00

(multiply line 7 by line 8a).

9. Sales tax due

00

00

00

00

00

(line 7 minus line 8b)

1

1 2

2 3

3