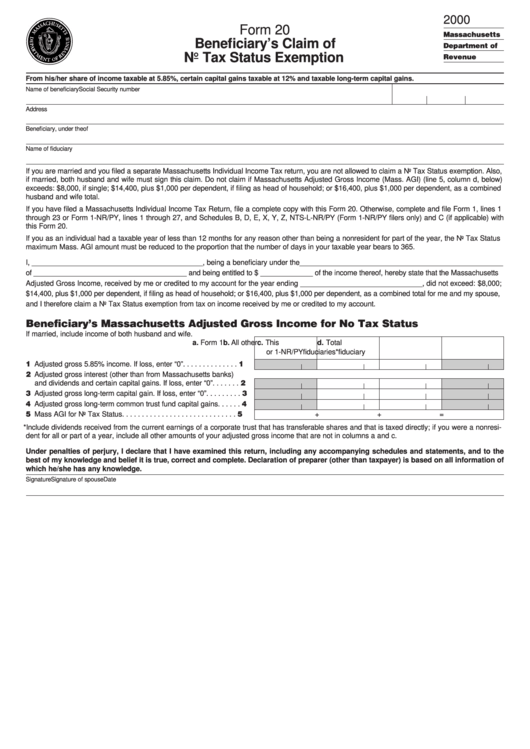

Form 20 - Beneficiary'S Claim Of No Tax Status Exemption - 2000

ADVERTISEMENT

2000

Form 20

Massachusetts

Beneficiary’s Claim of

Department of

No Tax Status Exemption

Revenue

From his/her share of income taxable at 5.85%, certain capital gains taxable at 12% and taxable long-term capital gains.

Name of beneficiary

Social Security number

Address

Beneficiary, under the

of

Name of fiduciary

If you are married and you filed a separate Massachusetts Individual Income Tax return, you are not allowed to claim a No Tax Status exemption. Also,

if married, both husband and wife must sign this claim. Do not claim if Massachusetts Adjusted Gross Income (Mass. AGI) (line 5, column d, below)

exceeds: $8,000, if single; $14,400, plus $1,000 per dependent, if filing as head of household; or $16,400, plus $1,000 per dependent, as a combined

husband and wife total.

If you have filed a Massachusetts Individual Income Tax Return, file a complete copy with this Form 20. Otherwise, complete and file Form 1, lines 1

through 23 or Form 1-NR/PY, lines 1 through 27, and Schedules B, D, E, X, Y, Z, NTS-L-NR/PY (Form 1-NR/PY filers only) and C (if applicable) with

this Form 20.

If you as an individual had a taxable year of less than 12 months for any reason other than being a nonresident for part of the year, the No Tax Status

maximum Mass. AGI amount must be reduced to the proportion that the number of days in your taxable year bears to 365.

I, __________________________________________, being a beneficiary under the __________________________________________________

of ______________________________________ and being entitled to $ _____________ of the income thereof, hereby state that the Massachusetts

Adjusted Gross Income, received by me or credited to my account for the year ending ______________________________, did not exceed: $8,000;

$14,400, plus $1,000 per dependent, if filing as head of household; or $16,400, plus $1,000 per dependent, as a combined total for me and my spouse,

and I therefore claim a No Tax Status exemption from tax on income received by me or credited to my account.

Beneficiary’s Massachusetts Adjusted Gross Income for No Tax Status

If married, include income of both husband and wife.

a. Form 1

b. All other

c. This

d. Total

or 1-NR/PY

fiduciaries*

fiduciary

1 Adjusted gross 5.85% income. If loss, enter “0” . . . . . . . . . . . . . . 1

2 Adjusted gross interest (other than from Massachusetts banks)

and dividends and certain capital gains. If loss, enter “0” . . . . . . . 2

3 Adjusted gross long-term capital gain. If loss, enter “0”. . . . . . . . . 3

4 Adjusted gross long-term common trust fund capital gains. . . . . . 4

5 Mass AGI for No Tax Status . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

+

+

=

*Include dividends received from the current earnings of a corporate trust that has transferable shares and that is taxed directly; if you were a nonresi-

dent for all or part of a year, include all other amounts of your adjusted gross income that are not in columns a and c.

Under penalties of perjury, I declare that I have examined this return, including any accompanying schedules and statements, and to the

best of my knowledge and belief it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of

which he/she has any knowledge.

Signature

Signature of spouse

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2