Credit Scores - Fair Isaac Corporation

ADVERTISEMENT

Credit Scores

“If winning isn’t everything, why do they keep score?” – Vince Lombardi

Range is 300-850:

850 - 780 - Low Risk

780 - 740 - Medium - Low Risk

740 - 690 - Medium Risk

690 - 620 - Medium - High Risk

Below 620 - High Risk (sub-prime)

These are general guidelines since there’s no one “score cutoff”

used by all lenders. Be aware that in the last year most lenders

have RAISED their minimum score. Also know that your score

can change from month to month and can be different at each of

the credit bureaus.

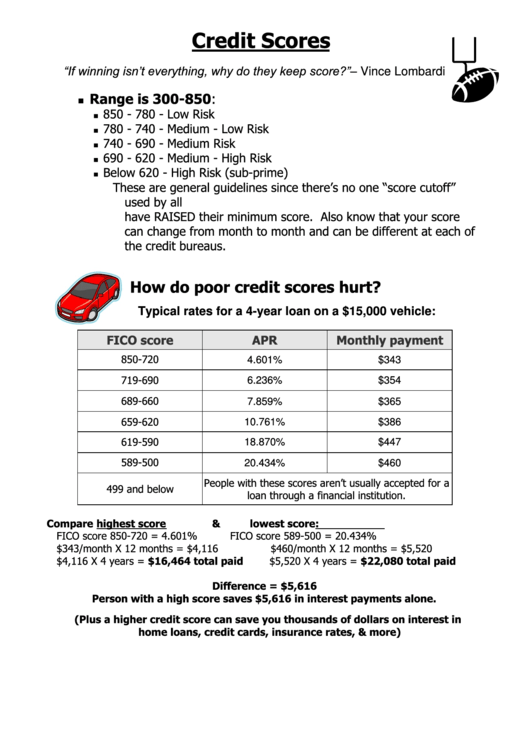

How do poor credit scores hurt?

Typical rates for a 4-year loan on a $15,000 vehicle:

FICO score

APR

Monthly payment

850-720

4.601%

$343

719-690

6.236%

$354

689-660

7.859%

$365

659-620

10.761%

$386

619-590

18.870%

$447

589-500

20.434%

$460

People with these scores aren’t usually accepted for a

499 and below

loan through a financial institution.

Compare highest score

&

lowest score:

FICO score 850-720 = 4.601%

FICO score 589-500 = 20.434%

$343/month X 12 months = $4,116

$460/month X 12 months = $5,520

$4,116 X 4 years = $16,464 total paid

$5,520 X 4 years = $22,080 total paid

Difference = $5,616

Person with a high score saves $5,616 in interest payments alone.

(Plus a higher credit score can save you thousands of dollars on interest in

home loans, credit cards, insurance rates, & more)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5