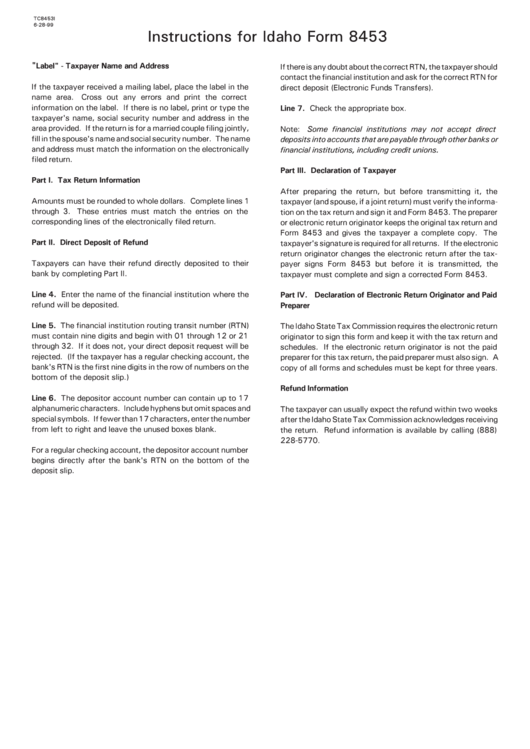

Instructions For Idaho Form 8453

ADVERTISEMENT

TC8453I

6-28-99

Instructions for Idaho Form 8453

"

Label" - Taxpayer Name and Address

If there is any doubt about the correct RTN, the taxpayer should

contact the financial institution and ask for the correct RTN for

If the taxpayer received a mailing label, place the label in the

direct deposit (Electronic Funds Transfers).

name area.

Cross out any errors and print the correct

information on the label. If there is no label, print or type the

Line 7. Check the appropriate box.

taxpayer's name, social security number and address in the

area provided. If the return is for a married couple filing jointly,

Note:

Some financial institutions may not accept direct

fill in the spouse's name and social security number. The name

deposits into accounts that are payable through other banks or

and address must match the information on the electronically

financial institutions, including credit unions.

filed return.

Part III. Declaration of Taxpayer

Part I. Tax Return Information

After preparing the return, but before transmitting it, the

Amounts must be rounded to whole dollars. Complete lines 1

taxpayer (and spouse, if a joint return) must verify the informa-

through 3. These entries must match the entries on the

tion on the tax return and sign it and Form 8453. The preparer

corresponding lines of the electronically filed return.

or electronic return originator keeps the original tax return and

Form 8453 and gives the taxpayer a complete copy. The

Part II. Direct Deposit of Refund

taxpayer's signature is required for all returns. If the electronic

return originator changes the electronic return after the tax-

Taxpayers can have their refund directly deposited to their

payer signs Form 8453 but before it is transmitted, the

bank by completing Part II.

taxpayer must complete and sign a corrected Form 8453.

Line 4. Enter the name of the financial institution where the

Part IV. Declaration of Electronic Return Originator and Paid

refund will be deposited.

Preparer

Line 5. The financial institution routing transit number (RTN)

The Idaho State Tax Commission requires the electronic return

must contain nine digits and begin with 01 through 12 or 21

originator to sign this form and keep it with the tax return and

through 32. If it does not, your direct deposit request will be

schedules. If the electronic return originator is not the paid

rejected. (If the taxpayer has a regular checking account, the

preparer for this tax return, the paid preparer must also sign. A

bank's RTN is the first nine digits in the row of numbers on the

copy of all forms and schedules must be kept for three years.

bottom of the deposit slip.)

Refund Information

Line 6. The depositor account number can contain up to 17

alphanumeric characters. Include hyphens but omit spaces and

The taxpayer can usually expect the refund within two weeks

special symbols. If fewer than 17 characters, enter the number

after the Idaho State Tax Commission acknowledges receiving

from left to right and leave the unused boxes blank.

the return. Refund information is available by calling (888)

228-5770.

For a regular checking account, the depositor account number

begins directly after the bank's RTN on the bottom of the

deposit slip.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1