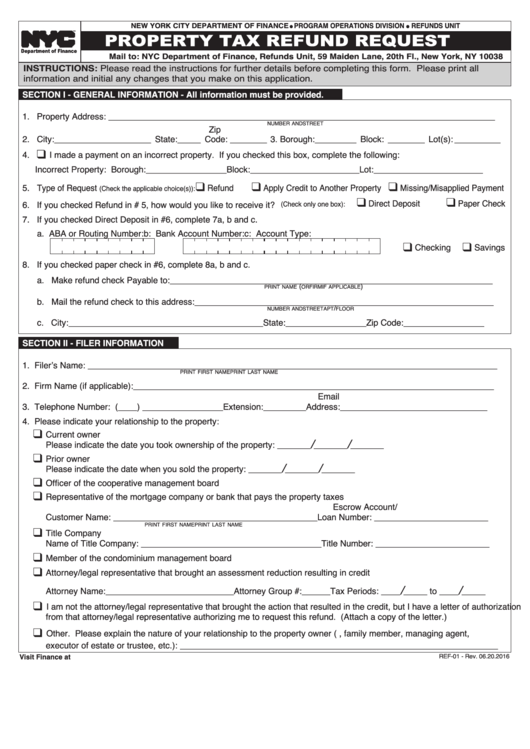

Form Ref-01 - Property Tax Refund Request

ADVERTISEMENT

PROPERTY TAX REFUND REQUEST

NEW YORK CITY DEPARTMENT OF FINANCE

PROGRAM OPERATIONS DIVISION

REFUNDS UNIT

l

l

TM

Mail to: NYC Department of Finance, Refunds Unit, 59 Maiden Lane, 20th Fl., New York, NY 10038

Department of Finance

INSTRUCTIONS: Please read the instructions for further details before completing this form. Please print all

information and initial any changes that you make on this application.

SECTION I - GENERAL INFORMATION - All information must be provided.

1. Property Address: ____________________________________________________________________________________

Zip

NUMBER AND STREET

2. City: _____________________ State:_____ Code: ________ 3. Borough:_________ Block: ________ Lot(s): __________

4.

I made a payment on an incorrect property. If you checked this box, complete the following:

q

Incorrect Property: Borough: _________________ Block:_______________________ Lot:_______________________

q

q

q

5. Type of Request

Refund

Apply Credit to Another Property

Missing/Misapplied Payment

(Check the applicable choice(s)):

q

Direct Deposit

q

Paper Check

6. If you checked Refund in # 5, how would you like to receive it?

(Check only one box):

7. If you checked Direct Deposit in #6, complete 7a, b and c.

a. ABA or Routing Number:

b: Bank Account Number:

c: Account Type:

Checking

Savings

q

q

8. If you checked paper check in #6, complete 8a, b and c.

a. Make refund check Payable to: ____________________________________________________________________

(

)

PRINT NAME

OR FIRM IF APPLICABLE

b. Mail the refund check to this address: _______________________________________________________________

/

NUMBER AND STREET

APT

FLOOR

c. City: _________________________________________ State:_________________ Zip Code: _________________

SECTION II - FILER INFORMATION

1. Filer’s Name: _________________________________________________________________________________________

PRINT FIRST NAME

PRINT LAST NAME

2. Firm Name (if applicable): ____________________________________________________________________________

Email

3. Telephone Number: (____) _________________ Extension: _________ Address: _______________________________

4. Please indicate your relationship to the property:

Current owner

q

/

/

Please indicate the date you took ownership of the property: _______

_______

_______

q

Prior owner

/

/

Please indicate the date when you sold the property: _______

_______

_______

q

Officer of the cooperative management board

Representative of the mortgage company or bank that pays the property taxes

q

Escrow Account/

Customer Name: ___________________________________________ Loan Number: ________________________

PRINT FIRST NAME

PRINT LAST NAME

q

Title Company

Name of Title Company: ______________________________________ Title Number: ________________________

Member of the condominium management board

q

q

Attorney/legal representative that brought an assessment reduction resulting in credit

/

/

Attorney Name: ___________________________ Attorney Group #: ______ Tax Periods: ____

_____ to ____

_____

q

I am not the attorney/legal representative that brought the action that resulted in the credit, but I have a letter of authorization

from that attorney/legal representative authorizing me to request this refund. (Attach a copy of the letter.)

Other. Please explain the nature of your relationship to the property owner (e.g., family member, managing agent,

q

executor of estate or trustee, etc.): ___________________________________________________________________

Visit Finance at nyc.gov/finance

REF-01 - Rev. 06.20.2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4