United States Citizenship Attestation Form

ADVERTISEMENT

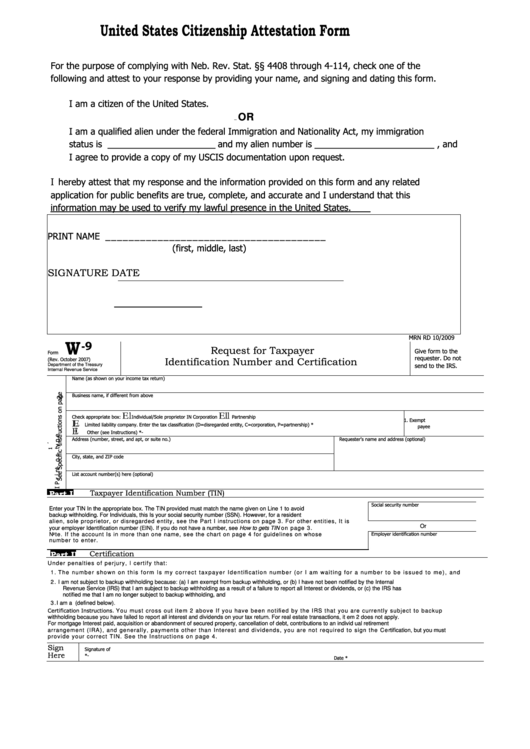

United States Citizenship Attestation Form

For the purpose of complying with Neb. Rev. Stat. §§ 4408 through 4-114, check one of the

following and attest to your response by providing your name, and signing and dating this form.

I am a citizen of the United States.

OR

—

I am a qualified alien under the federal Immigration and Nationality Act, my immigration

status is _______________________ and my alien number is ________________________ , and

I agree to provide a copy of my USCIS documentation upon request.

I

hereby attest that my response and the information provided on this form and any related

application for public benefits are true, complete, and accurate and I understand that t his

information may be used to verify my lawful presence in the United States.

PRINT NAME ______________________________________

(first, middle, last)

SIGNATURE DATE

MRN RD 10/2009

W

-9

Request for Taxpayer

G i v e f o r m t o t h e

F o r m

r e q u e s t e r . D o no t

( R e v . O c t o be r 2 0 0 7 )

Identification Number and Certification

s e n d t o t h e I R S .

Department of the Treasury

Internal Revenue Service

N a m e ( a s s h o w n o n y o u r i n c o m e ta x r e t u r n )

B u s in e ss n a m e , i f di ff e r e n t fr o m a bo v e

El

E l l

Check appropriate box:

Individual/Sole proprietor

IN

Corporation

Partnership

1.

Exempt

L E

Li mi te d li a bili ty com pan y. En ter th e ta x cl assifi ca ti on ( D =disr egar de d en ti t y, C =cor po ra ti on, P=par tne rshi p) * . . . . . . . . .

payee

E l

Other (see Instructions) *-

A ddr ess (num ber, s tr e e t, an d a pt, or sui te no .)

R e qu ester 's nam e an d a ddr ess (o pti on al)

C i t y , s t a t e , a n d Z I P c o de

Lis t a cc oun t num ber(s) h er e (o pti on al)

Part I

Taxpayer Identification Number (TIN)

S o c i a l s e c u r i t y n u m b e r

Enter your TIN In the appropriate box. The TIN provided must match the name given on Li ne 1 to avoid

backup wi thhol di ng. For Indi vidual s, thi s Is your social securi ty number (SSN). However, for a resi dent

alien, sole proprietor, or disregarded entity, see the Part I i nstructions on page 3. For other entities, It is

Or

your empl oyer Identification number (EIN). If you do not have a number, see How to gets TIN on page 3.

E m p l o y e r i d e n t i f i c a t i o n n u m b e r

Note. If the account Is in more than one name, see the chart on page 4 for guidelines on whose

num ber to e nter.

Part II

Certification

Und er pe nal ti es of perj ury, I certi fy that:

1 .

T he n um b e r s ho w n o n t hi s f o r m I s m y c o r r e c t t a xp a y e r I d e nt i fi c a ti o n n um b e r ( o r I a m w ai ti ng f o r a nu m b e r t o b e i s s ue d t o m e ) , a nd

2 .

I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by t he Internal

Revenue Service (IRS) that I am subject t o backup withholding as a result of a failure to report all Interest or dividends, or (c) the IRS has

no ti fi ed m e t ha t I a m no l o nge r s ubj ec t t o b ac k up wi t hhol di ng, a nd

3 .

I a m a U . S . c i t i z e n o r o t h e r U . S . p e r s o n ( d e f i n e d b e l o w ) .

C e rti fi cati on In st ru cti on s.

You m ust cross o ut i tem 2 above If y o u ha ve bee n noti fi ed by the IR S t hat yo u are c urre ntl y s ubj ect to back up

wi thholdi ng because you have failed to report all i nterest and divi dends on your tax return. For real estate transactions, it em 2 does not appl y.

For mortgage Interest pai d, acqui sition or abandonment of secured property, cancellation of debt, contributi ons to an i ndivi d ual reti rement

arrangeme nt (IR A), a nd ge neral l y, payme nts ot her t ha n I ntere st a nd d i vi dends, yo u ar e not req ui red to si gn t he Ce rti fi cati on, b ut yo u m ust

provi de your corr ect TIN. Se e t he I nstr ucti ons o n p age 4.

Sign

S i g n a t u r e o f

Here

U.S. person 1*-

D a t e *

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1