Application For Transaction Privilege (Sales) And Use Tax License - City Of Phoenix Finance Department

ADVERTISEMENT

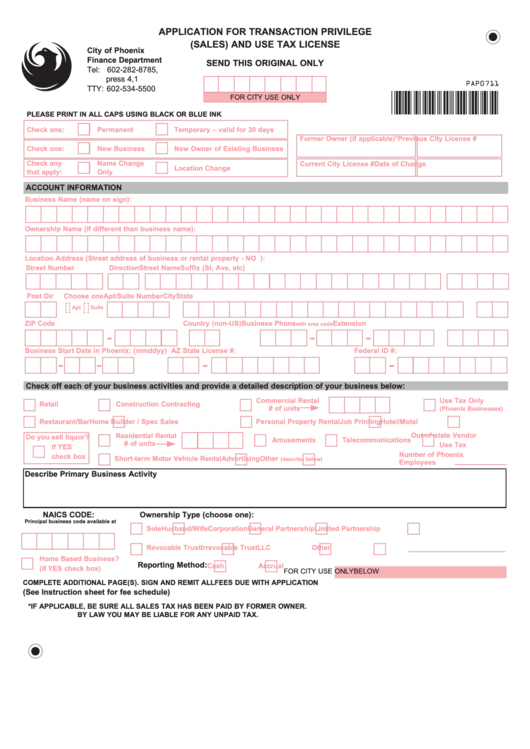

APPLICATION FOR TRANSACTION PRIVILEGE

(SALES) AND USE TAX LICENSE

City of Phoenix

Finance Department

SEND THIS ORIGINAL ONLY

Tel: 602-282-8785,

press 4,1

TTY: 602-534-5500

FOR CITY USE ONLY

PLEASE PRINT IN ALL CAPS USING BLACK OR BLUE INK

Check one:

Permanent

Temporary – valid for 30 days

Former Owner (if applicable)*

Previous City License #

Check one:

New Business

New Owner of Existing Business

Check any

Name Change

Current City License #

Date of Change

Location Change

that apply:

Only

ACCOUNT INFORMATION

Business Name (name on sign):

Ownership Name (If different than business name):

Location Address (Street address of business or rental property - NO P.O. Boxes or PMBs):

Street Number

Direction Street Name

Suffix (St, Ave, etc)

Post Dir

Choose one Apt/Suite Number

City

State

Apt

Suite

ZIP Code

Country (non-US)

Business Phone

Extension

with area code

Business Start Date in Phoenix: (mmddyy) AZ State License #:

Federal ID #:

Check off each of your business activities and provide a detailed description of your business below:

Commercial Rental

Use Tax Only

Retail

Construction Contracting

# of units

(Phoenix Businesses)

Restaurant/Bar

Home Builder / Spec Sales

Personal Property Rental

Job Printing

Hotel/Motel

Out-of-state Vendor

Residential Rental

Do you sell liquor?

Amusements

Telecommunications

# of units

Use Tax

If YES

Number of Phoenix

check box

Short-term Motor Vehicle Rental

Advertising

Other

(describe below)

Employees

Describe Primary Business Activity

NAICS CODE:

Ownership Type (choose one):

Principal business code available at

Sole

Husband/Wife

Corporation

General Partnership

Limited Partnership

Revocable Trust

Irrevocable Trust

LLC

Other

Home Based Business?

Reporting Method:

Cash

Accrual

(If YES check box)

FOR CITY USE ONLY BELOW

COMPLETE ADDITIONAL PAGE(S). SIGN AND REMIT ALL FEES DUE WITH APPLICATION

(See Instruction sheet for fee schedule)

*IF APPLICABLE, BE SURE ALL SALES TAX HAS BEEN PAID BY FORMER OWNER.

BY LAW YOU MAY BE LIABLE FOR ANY UNPAID TAX.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3