Form Char410 - Charities Registration Statement - 2002

ADVERTISEMENT

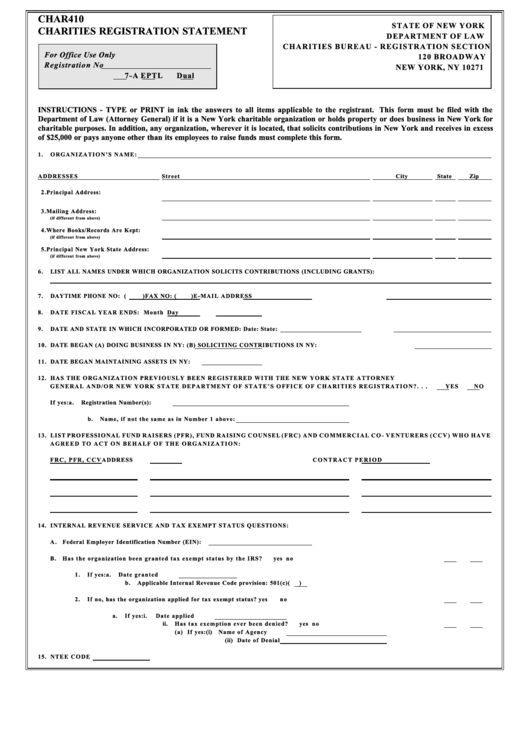

CHAR410

STATE OF NEW YORK

CHARITIES REGISTRATION STATEMENT

DEPARTMENT OF LAW

CHARITIES BUREAU - REGISTRATION SECTION

Fo r Office U se Only

120 BROADWAY

Registration No

NEW YOR K, NY 10271

7-A

EPTL

Dual

INSTRUCTIONS - TYPE or PRINT in ink the answers to all items applicable to the registrant. This form must be filed with the

Department of Law (Attorney General) if it is a New York charitable organization or holds property or does business in New York for

charitable purposes. In addition, any organization, wherever it is located, that solicits contributions in New York and receives in excess

of $25,000 or pays anyone other than its employees to raise funds must complete this form.

1.

ORGAN IZATION’S NAME:

ADDRESSES

Street

City

State

Zip

2. Principal A ddress:

3. M ailing A ddress:

(if different from above)

4. W her e Bo oks/ Re cord s Ar e K ept:

(if different from above)

5. Principal N ew Y ork State A ddress:

(if different from above)

6.

LIS T A LL NA M ES U ND ER W HI CH OR GA NIZ AT IO N S OL ICIT S C ON TR IBU TIO NS (INC LU DIN G G RA NT S):

7.

DA YT IM E P HO NE NO : (

)

FA X N O: (

)

E-MAIL ADD RESS

8.

DATE FISCAL YEAR EN DS: Month

Day

9.

DA TE AN D S TA TE IN W HI CH INC OR PO RA TE D O R F OR M ED :

Date :

State:

10. DA TE BE GA N (A ) DO ING BU SIN ESS IN N Y:

(B) SO LIC ITIN G C ON TR IBU TIO NS IN N Y:

11. DA TE BE GA N M AIN TA ININ G A SSE TS I N N Y:

12. HAS THE OR GANIZATION PREVIOUSLY BEEN REGISTERED WITH THE N EW YO RK STATE ATTORN EY

G E N E R A L A N D / O R N E W Y O R K S TA T E D EP A R T M E N T O F S T A TE ’S O F F IC E O F C H A R IT IE S R EG I ST R A T IO N ? . . .

YES

N O

If yes:

a.

Re gistration N um ber (s):

b.

Name, if not the same as in Num ber 1 above:

13. LIST PROFESSIONAL FUND RAISERS (PFR), FUND RAISING COUNSEL ( FR C ) A N D C O M M E R C I A L C O - VE N T U R ER S (C C V ) W H O H A V E

A G R E E D TO A C T O N B E H A LF O F T H E O R G A N IZ A T IO N :

F R C , P F R , C C V

ADDR ESS

C O N T RA C T PE R IO D

14. INTERNAL R EVENUE SERVICE AN D TAX EX EMPT STATUS Q UESTIONS:

A . Fed eral E mp loyer Id entification Nu mb er (E IN):

B.

Has the organization been granted tax exempt status by the IRS? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

yes

no

1.

If yes:

a.

Date granted

b.

Ap plicable In terna l Rev enu e C ode p rovision : 501(c)(

)

2.

If no, has the org anization applied for tax e xem pt status? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

yes

no

a.

If yes:

i.

Date applied

ii.

Has tax exemption ever been denied? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

yes

no

(a) If yes:

(i)

Name of Agency

(ii) Date of Denial

15. NTEE CODE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2