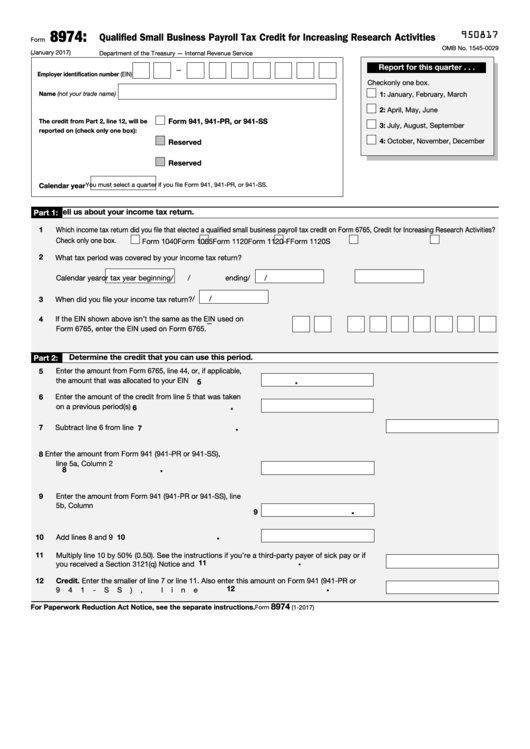

8974:

950817

Qualified Small Business Payroll Tax Credit for Increasing Research Activities

Form

OMB No. 1545-0029

(January 2017)

Department of the Treasury — Internal Revenue Service

Report for this quarter . . .

—

Employer identification number (EIN)

Check only one box.

Name (not your trade name)

1: January, February, March

2: April, May, June

Form 941, 941-PR, or 941-SS

The credit from Part 2, line 12, will be

3: July, August, September

reported on (check only one box):

4: October, November, December

Reserved

Reserved

Calendar year

You must select a quarter if you file Form 941, 941-PR, or 941-SS.

Tell us about your income tax return.

Part 1:

1

Which income tax return did you file that elected a qualified small business payroll tax credit on Form 6765, Credit for Increasing Research Activities?

Check only one box.

Form 1040

Form 1065

Form 1120

Form 1120-F

Form 1120S

2

What tax period was covered by your income tax return?

Calendar year

or tax year beginning

/

/

ending

/

/

/

/

3

When did you file your income tax return?

If the EIN shown above isn’t the same as the EIN used on

4

—

Form 6765, enter the EIN used on Form 6765.

Determine the credit that you can use this period.

Part 2:

5

Enter the amount from Form 6765, line 44, or, if applicable,

.

the amount that was allocated to your EIN

.

.

.

.

.

5

6

Enter the amount of the credit from line 5 that was taken

.

on a previous period(s) .

.

.

.

.

.

.

.

.

.

.

6

.

7

Subtract line 6 from line 5 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Enter the amount from Form 941 (941-PR or 941-SS),

.

line 5a, Column 2

.

.

.

.

.

.

.

.

.

.

.

.

8

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Enter the amount from Form 941 (941-PR or 941-SS), line

.

5b, Column 2 .

.

.

.

.

.

.

.

.

.

.

.

.

.

9

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

10

Add lines 8 and 9

.

.

.

.

.

.

.

.

.

.

.

.

11

Multiply line 10 by 50% (0.50). See the instructions if you’re a third-party payer of sick pay or if

.

11

you received a Section 3121(q) Notice and Demand .

.

.

.

.

.

.

.

.

.

.

.

.

.

Credit. Enter the smaller of line 7 or line 11. Also enter this amount on Form 941 (941-PR or

12

.

12

941-SS), line 11 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8974

For Paperwork Reduction Act Notice, see the separate instructions.

Form

(1-2017)

IRS.gov/form8974

Cat. No. 37797C

1

1