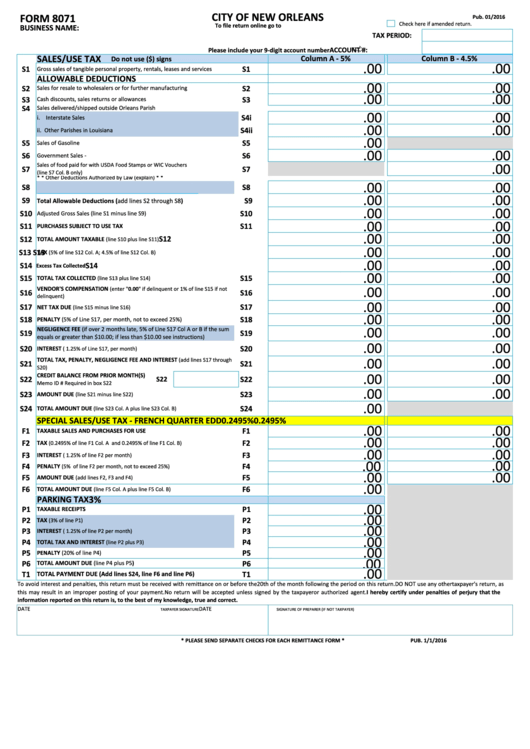

Form 8071 - Sales/use Tax - City Of New Orleans

ADVERTISEMENT

CITY OF NEW ORLEANS

FORM 8071

Pub. 01/2016

Check here if amended return.

To file return online go to

BUSINESS NAME:

TAX PERIOD:

ACCOUNT #:

Please include your 9-digit account number

SALES/USE TAX

Column A - 5%

Column B - 4.5%

Do not use ($) signs

.00

.00

S1

S1

Gross sales of tangible personal property, rentals, leases and services

ALLOWABLE DEDUCTIONS

.00

.00

S2

S2

Sales for resale to wholesalers or for further manufacturing

.00

.00

S3

S3

Cash discounts, sales returns or allowances

S4

Sales delivered/shipped outside Orleans Parish

.00

.00

S4i

i. Interstate Sales

.00

.00

S4ii

ii. Other Parishes in Louisiana

.00

S5

S5

Sales of Gasoline

.00

.00

S6

S6

Government Sales - U.S./Louisiana/LA. Parishes

.00

Sales of food paid for with USDA Food Stamps or WIC Vouchers

S7

S7

(line S7 Col. B only)

* * Other Deductions Authorized by Law (explain) * *

.00

.00

S8

S8

__________________________________________________________________

.00

.00

S9

S9

Total Allowable Deductions (add lines S2 through S8)

.00

.00

S10

S10

Adjusted Gross Sales (line S1 minus line S9)

.00

.00

S11

S11

PURCHASES SUBJECT TO USE TAX

.00

.00

S12

S12

TOTAL AMOUNT TAXABLE

(line S10 plus line S11)

.00

.00

S13

S13

TAX

(5% of line S12 Col. A; 4.5% of line S12 Col. B)

.00

.00

S14

S14

Excess Tax Collected

.00

.00

S15

S15

TOTAL TAX COLLECTED

(line S13 plus line S14)

VENDOR'S COMPENSATION

.00

.00

(enter "0.00" if delinquent or 1% of line S15 if not

S16

S16

delinquent)

.00

.00

S17

S17

NET TAX DUE

(line S15 minus line S16)

.00

.00

S18

S18

PENALTY (5% of Line S17, per month, not to exceed 25%)

NEGLIGENCE FEE (if over 2 months late, 5% of Line S17 Col A or B if the sum

.00

.00

S19

S19

equals or greater than $10.00; if less than $10.00 see instructions)

.00

.00

S20

S20

INTEREST

( 1.25% of Line S17, per month)

TOTAL TAX, PENALTY, NEGLIGENCE FEE AND INTEREST

.00

.00

(add lines S17 through

S21

S21

S20)

CREDIT BALANCE FROM PRIOR MONTH(S)

.00

.00

S22

S22

S22

Memo ID # Required in box S22

.00

.00

S23

S23

AMOUNT DUE

(line S21 minus line S22)

.00

S24

S24

TOTAL AMOUNT DUE

(line S23 Col. A plus line S23 Col. B)

SPECIAL SALES/USE TAX - FRENCH QUARTER EDD

0.2495%

0.2495%

.00

.00

F1

F1

TAXABLE SALES AND PURCHASES FOR USE

.00

.00

F2

F2

TAX

(0.2495% of line F1 Col. A and 0.2495% of line F1 Col. B)

.00

.00

F3

F3

INTEREST

( 1.25% of line F2 per month)

.00

.00

F4

F4

PENALTY

(5% of line F2 per month, not to exceed 25%)

.00

.00

F5

F5

AMOUNT DUE

(add lines F2, F3 and F4)

.00

F6

F6

TOTAL AMOUNT DUE

(line F5 Col. A plus line F5 Col. B)

3%

PARKING TAX

.00

P1

P1

TAXABLE RECEIPTS

.00

P2

P2

TAX

(3% of line P1)

.00

P3

P3

INTEREST

( 1.25% of line P2 per month)

.00

P4

P4

TOTAL TAX AND INTEREST

(line P2 plus P3)

.00

P5

P5

PENALTY (20% of line P4)

.00

P6

P6

TOTAL AMOUNT DUE (line P4 plus P5)

.00

T1

TOTAL PAYMENT DUE (Add lines S24, line F6 and line P6)

T1

To avoid interest and penalties, this return must be received with remittance on or before the 20th of the month following the period on this return. DO NOT use any other taxpayer's return, as

this may result in an improper posting of your payment. No return will be accepted unless signed by the taxpayer or authorized agent. I hereby certify under penalties of perjury that the

information reported on this return is, to the best of my knowledge, true and correct.

DATE

DATE

DATE

TAXPAYER SIGNATURE

DATE

SIGNATURE OF PREPARER (IF NOT TAXPAYER)

TAXPAYER SIGNATURE

SIGNATURE OF PREPARER (IF NOT TAXPAYER)

* PLEASE SEND SEPARATE CHECKS FOR EACH REMITTANCE FORM *

PUB. 1/1/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1