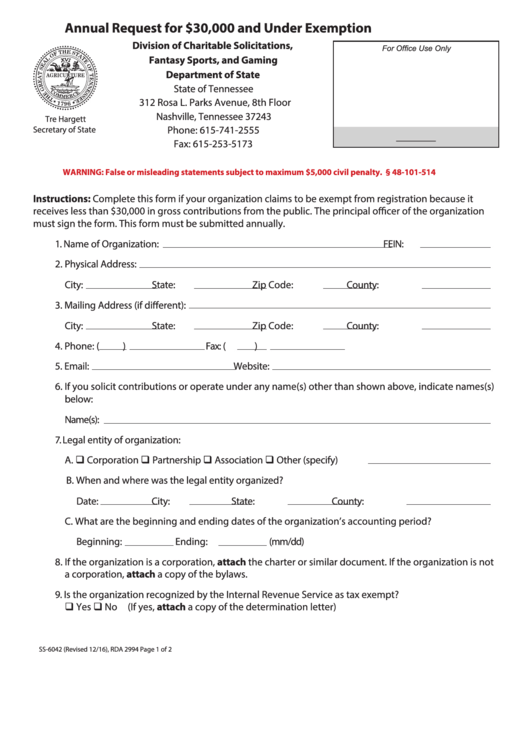

Annual Request for $30,000 and Under Exemption

Division of Charitable Solicitations,

For Office Use Only

Fantasy Sports, and Gaming

Department of State

State of Tennessee

312 Rosa L. Parks Avenue, 8th Floor

Nashville, Tennessee 37243

Tre Hargett

Phone: 615-741-2555

Secretary of State

_________

Fax: 615-253-5173

sos.tn.gov/charitable

WARNING: False or misleading statements subject to maximum $5,000 civil penalty. T.C.A. § 48-101-514

Instructions: Complete this form if your organization claims to be exempt from registration because it

receives less than $30,000 in gross contributions from the public. The principal officer of the organization

must sign the form. This form must be submitted annually.

1. Name of Organization:

FEIN:

2. Physical Address:

City:

State:

Zip Code:

County:

3. Mailing Address (if different):

City:

State:

Zip Code:

County:

4. Phone: (

)

Fax: (

)

5. Email:

Website:

6. If you solicit contributions or operate under any name(s) other than shown above, indicate names(s)

below:

Name(s):

7. Legal entity of organization:

A. Corporation Partnership Association Other (specify)

B. When and where was the legal entity organized?

Date:

City:

State:

County:

C. What are the beginning and ending dates of the organization’s accounting period?

Beginning:

Ending:

(mm/dd)

8. If the organization is a corporation, attach the charter or similar document. If the organization is not

a corporation, attach a copy of the bylaws.

9. Is the organization recognized by the Internal Revenue Service as tax exempt?

Yes No (If yes, attach a copy of the determination letter)

SS-6042 (Revised 12/16), RDA 2994

Page 1 of 2

1

1 2

2