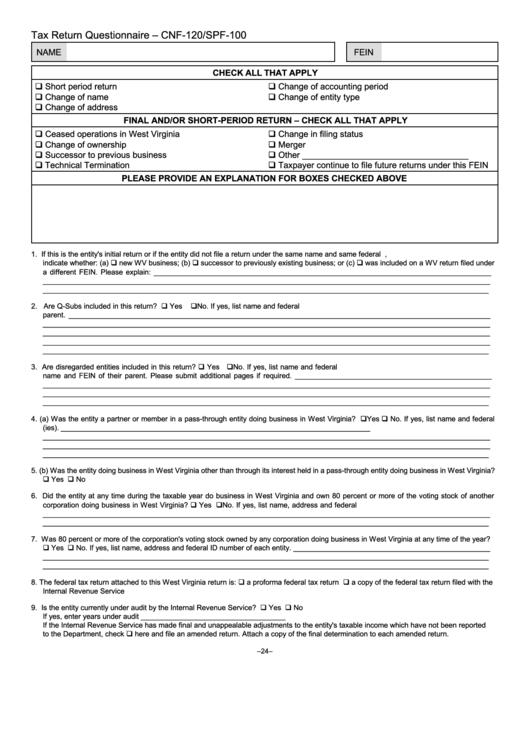

Tax Return Questionnaire – CNF-120/SPF-100

NaME

FEIN

CHECK ALL THAT APPLY

short period return

Change of accounting period

Change of name

Change of entity type

Change of address

FINAL AND/OR SHORT-PERIOD RETURN – CHECK ALL THAT APPLY

Ceased operations in West Virginia

Change in filing status

Change of ownership

Merger

successor to previous business

other ___________________________________

Technical Termination

Taxpayer continue to file future returns under this FEIN

PLEASE PROViDE AN ExPLANATiON FOR BOxES CHECKED ABOVE

1. If this is the entity's initial return or if the entity did not file a return under the same name and same federal I.D. number for the preceding year,

indicate whether: (a) new WV business; (b) successor to previously existing business; or (c) was included on a WV return filed under

a different FEIN. Please explain: ____________________________________________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

2. are Q-subs included in this return? Yes

No. If yes, list name and federal I.d. number of each Q-sub and the name and FEIN of their

parent. _________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

3. are disregarded entities included in this return? Yes No. If yes, list name and federal I.d. number of each disregarded entity and the

name and FEIN of their parent. Please submit additional pages if required. _________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

4. (a) Was the entity a partner or member in a pass-through entity doing business in West Virginia? Yes No. If yes, list name and federal

I.d. number of the pass-through entity(ies). _____________________________________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

5. (b) Was the entity doing business in West Virginia other than through its interest held in a pass-through entity doing business in West Virginia?

Yes No

6. did the entity at any time during the taxable year do business in West Virginia and own 80 percent or more of the voting stock of another

corporation doing business in West Virginia? Yes No. If yes, list name, address and federal I.d. number of each entity. ___________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

7. Was 80 percent or more of the corporation's voting stock owned by any corporation doing business in West Virginia at any time of the year?

Yes No. If yes, list name, address and federal Id number of each entity. _________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

8. The federal tax return attached to this West Virginia return is: a proforma federal tax return a copy of the federal tax return filed with the

Internal Revenue service

9. Is the entity currently under audit by the Internal Revenue service? Yes No

If yes, enter years under audit ____________________________________

If the Internal Revenue Service has made final and unappealable adjustments to the entity's taxable income which have not been reported

to the department, check here and file an amended return. Attach a copy of the final determination to each amended return.

–24–

1

1