Business And Occupation Tax - City Of Cosmopolis

ADVERTISEMENT

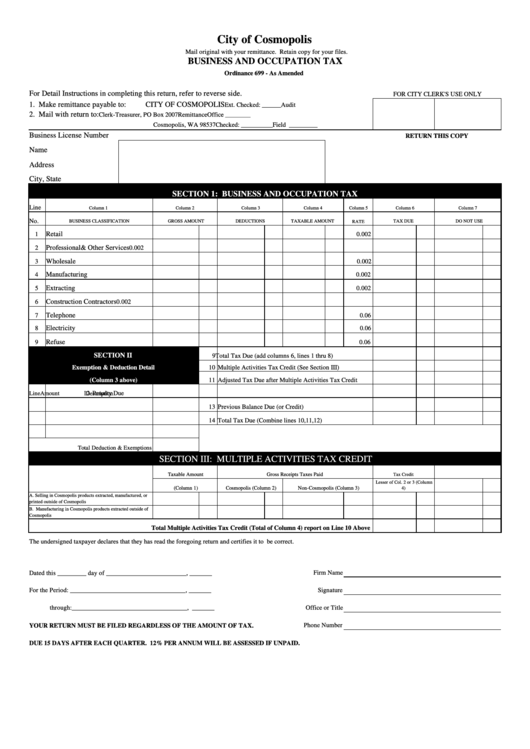

City of Cosmopolis

Mail original with your remittance. Retain copy for your files.

BUSINESS AND OCCUPATION TAX

Ordinance 699 - As Amended

For Detail Instructions in completing this return, refer to reverse side.

FOR CITY CLERK'S USE ONLY

1. Make remittance payable to:

CITY OF COSMOPOLIS

Ext. Checked: ______ Audit

2. Mail with return to:

Clerk-Treasurer, PO Box 2007

Remittance

Office ________

Cosmopolis, WA 98537

Checked: __________ Field _________

Business License Number

RETURN THIS COPY

Name

Address

City, State

SECTION 1: BUSINESS AND OCCUPATION TAX

Line

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

No.

BUSINESS CLASSIFICATION

GROSS AMOUNT

DEDUCTIONS

TAXABLE AMOUNT

RATE

TAX DUE

DO NOT USE

1

Retail

0.002

2

Professional& Other Services

0.002

Wholesale

3

0.002

Manufacturing

4

0.002

Extracting

5

0.002

Construction Contractors

6

0.002

Telephone

7

0.06

Electricity

8

0.06

Refuse

9

0.06

SECTION II

9 Total Tax Due (add columns 6, lines 1 thru 8)

Exemption & Deduction Detail

10 Multiple Activities Tax Credit (See Section III)

(Column 3 above)

11 Adjusted Tax Due after Multiple Activities Tax Credit

12 Penalty Due

Line

Description

Amount

13 Previous Balance Due (or Credit)

14 Total Tax Due (Combine lines 10,11,12)

Total Deduction & Exemptions

SECTION III: MULTIPLE ACTIVITIES TAX CREDIT

Taxable Amount

Gross Receipts Taxes Paid

Tax Credit

Lesser of Col. 2 or 3 (Column

(Column 1)

Cosmopolis (Column 2)

Non-Cosmopolis (Column 3)

4)

A. Selling in Cosmopolis products extracted, manufactured, or

printed outside of Cosmopolis

B. Manufacturing in Cosmopolis products extracted outside of

Cosmopolis

Total Multiple Activities Tax Credit (Total of Column 4) report on Line 10 Above

The undersigned taxpayer declares that they has read the foregoing return and certifies it to be correct.

Dated this _________ day of _________________________, _______

Firm Name

For the Period: ____________________________________, _______

Signature

through:____________________________________, _______

Office or Title

YOUR RETURN MUST BE FILED REGARDLESS OF THE AMOUNT OF TAX.

Phone Number

DUE 15 DAYS AFTER EACH QUARTER. 12% PER ANNUM WILL BE ASSESSED IF UNPAID.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1