Instructions For Form At3-51 - Personal Property Return Of Sole Proprietorships And General Partnerships - 2015

ADVERTISEMENT

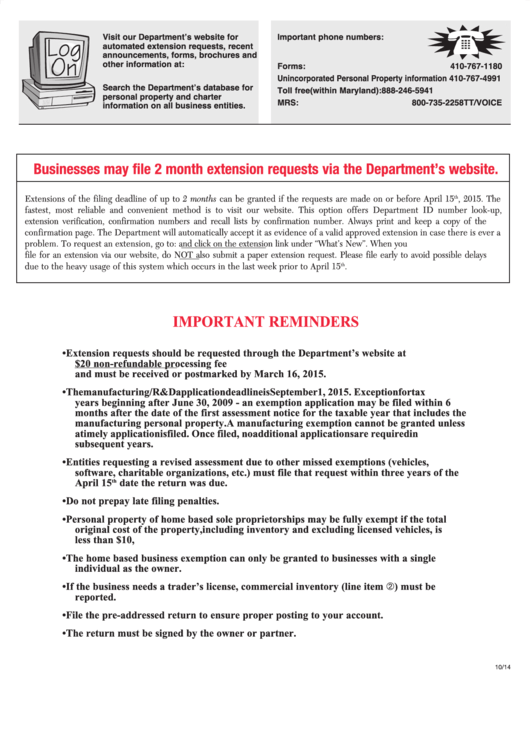

Visit our Department’s website for

Important phone numbers:

automated extension requests, recent

announcements, forms, brochures and

other information at:

Forms:

410-767-1180

Unincorporated Personal Property information 410-767-4991

Search the Department’s database for

Toll free (within Maryland):

888-246-5941

personal property and charter

MRS:

800-735-2258TT/VOICE

information on all business entities.

Businesses may file 2 month extension requests via the Department’s website.

Extensions of the filing deadline of up to 2 mont s can be granted if the requests are made on or before pril 15

th

, 2015. The

fastest, most reliable and convenient method is to visit our website. This option offers Department ID number look-up,

extension verification, confirmation numbers and recall lists by confirmation number.

lways print and keep a copy of the

confirmation page. The Department will automatically accept it as evidence of a valid approved extension in case there is ever a

problem. To request an extension, go to: and click on the extension link under “What’s New”. When you

file for an extension via our website, do NOT also submit a paper extension request. Please file early to avoid possible delays

due to the heavy usage of this system which occurs in the last week prior to pril 15

th

.

IMPORTANT REMINDERS

• Extension requests should be requested through the Department’s website at

. Paper extensions require a $20 non-refundable processing fee

and must be received or postmarked by March 16, 2015.

• The manufacturing/R&D application deadline is September 1, 2015. Exception for tax

years beginning after June 30, 2009 - an exemption application may be filed within 6

months after the date of the first assessment notice for the taxable year that includes the

manufacturing personal property. A manufacturing exemption cannot be granted unless

a timely application is filed. Once filed, no additional applications are required in

subsequent years.

• Entities requesting a revised assessment due to other missed exemptions (vehicles,

software, charitable organizations, etc.) must file that request within three years of the

April 15

th

date the return was due.

• Do not prepay late filing penalties.

• Personal property of home based sole proprietorships may be fully exempt if the total

original cost of the property, including inventory and excluding licensed vehicles, is

less than $10,000. An initial return must be filed to receive this exemption.

• The home based business exemption can only be granted to businesses with a single

individual as the owner.

• If the business needs a trader’s license, commercial inventory (line item ) must be

reported.

• File the pre-addressed return to ensure proper posting to your account.

• The return must be signed by the owner or partner.

10/1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6